Dealing with PAYE errors

Penalties are fines issued by HMRC where a person has not done something they should have. They are generally charged for either not doing something at the correct time, or not doing something accurately. Here we look at what might happen if you operate Pay As You Earn (PAYE) incorrectly.

Content on this page:

Sending in your employee information late (or not at all)

Under Real Time Information (RTI), most employers must submit information electronically to HMRC each time they make a payment to an employee.

For paper filers exempt from online filing, a return must be made once a quarter.

If you do not send in your payroll information on time (or at all), the position regarding penalties is as follows:

Penalties potentially apply to all employers for late filing of PAYE submissions. HMRC will usually informally allow a three-day grace period meaning that they may not charge a late filing penalty for delays of up to three days after the statutory filing date. However, employers who persistently file after the statutory filing date but within three days will be monitored and may be contacted or considered for a penalty.

In all cases, the first late submission of the tax year is ignored. However, second and subsequent failures may attract a penalty. The details of how the penalty is calculated are on GOV.UK, but broadly the penalty will be determined by the number of employees. The minimum penalty is £100 (applied per month, but charged quarterly). An additional tax-geared penalty may be applied if a return is outstanding for three months or more.

New employers can send their first submission within 30 days of first paying an employee without incurring any penalties. This late filing is also ignored for the purposes of determining the first tax month in which a return is filed late.

Even if you qualify for one of these concessions, you may still receive a generic notification message (see below) advising you of a default – you won’t get charged a penalty, but this is HMRC’s way of trying to educate you.

In addition, if you do not submit your payroll information on time, HMRC can estimate what PAYE you would owe based on your previous PAYE submission history. You can find out more about this on GOV.UK although we have not heard of this power being used very often.

Please note that where one of the concessions does not apply, late filing penalties will still not be charged if the taxpayer has a reasonable excuse. HMRC have suggested that they will accept ‘reasonable excuses’ (see below) from taxpayers who are generally compliant without further investigation. This is so that they can concentrate their efforts on the more serious defaulters on a risk-assessed basis.

You should note that late filing penalties can be levied even if the associated payment of PAYE tax/NIC has reached HMRC on time.

Benefits and expenses

Penalties can also be charged for late filing of forms P11D. For each form, there is potentially an initial penalty of up to £300 plus £60 a day if the failure continues.

You might also get a penalty of £100 per 50 employees for each month or part month a P11D(b) is late.

Paying your PAYE tax and NIC late

Interest and penalties may be levied where a person is late in making payments of PAYE tax and class 1/1A/1B NIC in the tax year. You should note that late payment interest and penalties can be levied even if the associated payroll information has reached HMRC on time.

The amount of the penalty will depend on the number of late payments (known as ‘defaults’) in the tax year and can range from 1% to 4%. The first late payment does not count as a default.

This means that if, for the first time in a tax year, you have made a late payment, you will not be given a penalty. You should however do everything you can to pay on time in future, because if you default on two payments in a tax year (in other words, you miss the payment deadline again), you will be fined 1% of the total of those defaults. If you miss four payments in a tax year, the penalty is 2% of the total of those defaults, 7 is then 3% and so on.

You should also be aware that if any amount of PAYE is more than six months late, a penalty of 5% of the amount outstanding will be levied. Another 5% will be charged if the PAYE is still outstanding after 12 months. These penalties apply to the first late payment of tax even though the first late payment does not count for the default penalties explained above.

You can find more information about this on GOV.UK.

Please note that it is our understanding that HMRC allow a ‘tolerance’ of £100 for PAYE in-year late payment penalties (that is, they will not issue a penalty if the amount underpaid is £100 or less).

Penalties will also not be charged if the taxpayer has a 'reasonable excuse' (see below) for the late payment.

However, interest may be applied to late payments, even if no penalties are levied. The current official interest rate is listed on GOV.UK.

You should be aware that HMRC interest rates are linked to the Bank of England base rate. Over the last year, the interest rate for late payment of tax has more than doubled so late payment interest may now be a bigger consideration than before.

Generic notification messages (GNS)

Online filers may get a GNS if they don't send their payroll submissions on time (or at all), or they are late making payments, or full payments to HMRC. These messages are intended to help employers get things right and avoid incurring penalties.

Some of the notifications you may see are set out below.

- A non-filing notice

-

Every PAYE scheme will have a filing expectation based on the frequency of previous submissions. As such, this GNS will be sent to an employer who appears not to have sent one or more of the Full Payment Submissions (FPS) that HMRC expected for a particular period. It will explain that the employer is running the risk of incurring penalties – and what to do to avoid them.

- A late filing notice

-

This will be sent to an employer who appears to have submitted an FPS late. HMRC will compare the date of the submission of the FPS with the date of payments to individuals within it and if it appears to them you have sent in a submission late (remember, the usual deadline for sending in payroll information is ‘on or before’ the date of payment), you may receive a GNS.

- A late payment notice

-

HMRC carries out payment checks after each monthly (or quarterly) payment deadline is passed. This GNS will be sent out by HMRC if an employer has not made their PAYE payments (as shown as due from their records) in full by their due date. It will explain that in order to avoid potential penalties in future, employers should bring payments up-to-date and ensure future payments are made on time and in full. It will also explain what to do if no payments were actually due.

Most users of commercial payroll software who make their submissions over the internet will receive the notifications through their software automatically. If the payroll software is not compatible or HMRC’s Basic PAYE Tools are used, the notifications will be available by logging on to HMRC's PAYE Online for employers service and selecting the notification from within the ‘Notice summary’ section.

You can find out more about GNS and what to do if you get one on GOV.UK.

Sending incorrect employee information

Where HMRC discovers careless or deliberate errors in pay and tax information submissions, including P11D(b) forms, the penalties that could apply will be based on the behaviour that led to the error and the amount of potential tax lost because of the inaccuracy.

Of course, an incorrect submission may just be a mistake you have made innocently when you run your payroll. These things can happen and HMRC recognise that. As such, errors that arise despite taking reasonable care (see below), attract no penalty at all and penalties for errors due to failure to take reasonable care can be reduced to zero with full and unprompted disclosure to HMRC. For information about disclosure see HMRC’s guidance.

It is important to understand that errors that lead to no lost tax cannot, by definition, attract a penalty.

If a penalty is charged because a taxpayer failed to take reasonable care, the penalty may be suspended by HMRC for up to 2 years. If the conditions set by HMRC are met by the taxpayer at the end of the suspension period, the penalty will be cancelled.

Benefits and expenses

Incorrect forms P11D are not dealt with by these rules. If an incorrect form P11D is filed fraudulently or negligently, a penalty of up to £3,000 can be levied in respect of each form. However, this will only be seen in the most serious cases.

How HMRC find out about errors

HMRC sometimes undertake PAYE audits (Employer Compliance Reviews) to make sure that employers are operating PAYE correctly. You can be randomly chosen for a PAYE inspection or you could be specifically selected if you do things like file payroll submissions late, pay tax late or make errors that need correcting.

The first step is a letter or phone call from HMRC announcing its intention to inspect your records.

They will probably want to concentrate on common problematic areas such as correct use of employee tax codes, correct treatment of new employees and leavers, expense payments, employee benefits and their correct disclosure on forms P11D and tax status.

You can read more about what to expect in a PAYE audit in our information on getting tax status wrong.

In general, you should try and assist the HMRC officers as much as possible. This will typically make it a shorter, more pleasant experience for all parties and if the worst happens and some error is discovered, minimise the penalty level. In a similar vein, if your preparation has highlighted any problems or mistakes, let the officers know. They will be more sympathetic if you tell them about any issues without being prompted, and you are far less likely to have to pay any penalties.

If it looks like a penalty may be in point but you have made a genuine mistake and are willing to meet conditions aimed at avoiding further inaccuracies in future, HMRC can suspend the penalty as discussed above under the heading: Sending incorrect employee information. Find out more about this in HMRC’s factsheet.

You can find a good article, explaining more about HMRC’s approach to conducting compliance checks since the Covid pandemic, with some top tips on how to prepare, on the Chartered Institute of Payroll Professionals’ website here.

Employers who have made a mistake in running their payroll should try and correct it (see below) as soon as possible, not least because this will help ensure that employees who receive universal credit, will get the correct amount of benefit.

Correcting payroll errors

In an ideal world, you would not need to correct errors, but occasionally even the most diligent employers will forget to process something or deal with something incorrectly. Whatever the reason, and even if you will get a penalty anyway, you must try and correct the mistake so that HMRC have payroll information and figures that are accurate.

Online filers can find some guidance on what to do on GOV.UK.

Users of HMRC’s Basic PAYE Tools (BPT) should check the user guide which contains step-by-step help on the most common functions of BPT, including how to amend or correct details of an employee payment and how to add a mis-timed employee payment.

If you are paper filing, guidance on what to do to correct payroll errors can be found in booklet RT7 – Guidance for employers exempt from filing Real Time Information online.

We also look at how you should correct an overpayment of salary on our pay and deductions page.

Benefits and expenses

You used to only be able to correct P11D errors by submitting a paper form, even if you originally submitted online; however since 2023/24 this has changed.

There may be penalties for any errors on the form (inaccuracy penalties), even where these are subsequently amended – see the our guidance above under the heading: Sending incorrect employee information.

Keeping good records

There are also penalties that HMRC can charge if you fail to keep proper records. It is important that you are aware of this.

You can find out what happens if you do not keep proper records on GOV.UK.

Appealing penalties

Late filing penalties/late payment penalties

If you do not agree with a PAYE penalty notice you receive, because the penalty is not due or because you had a reasonable excuse, you have the right to appeal against it.

A reasonable excuse is normally something unexpected or outside your control that stopped you meeting a tax obligation. The following list shows some examples of possible reasonable excuses, however HMRC will decide based on the individual circumstances whether they accept the excuse in your case:

- your partner or another close relative died shortly before the tax return or payment deadline

- you had an unexpected stay in hospital that prevented you from dealing with your tax affairs

- you had a serious or life-threatening illness

- your computer or software failed just before or while you were preparing your online return

- service issues with HMRC's online services

- a fire, flood or theft prevented you from completing your tax return

- postal delays that you couldn’t have predicted

You can read more about reasonable excuse elsewhere on the LITRG website.

You can also appeal against HMRC's decision not to accept your reasonable excuse if you still think you have a reasonable excuse.

Online filers are able to appeal online against a filing or payment penalty, using HMRC’s Basic PAYE Tools (BPT) payroll program (if you use it) and/or HMRC’s PAYE Online for employers service.

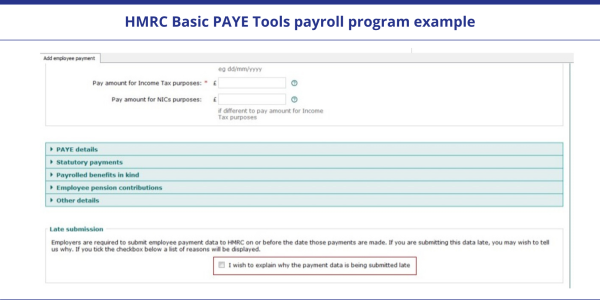

If you have a valid reason for sending your FPS late and use HMRC’s BPT, you can tick the late submission box and give your reason. By ticking the check box highlighted below a list of reasons will be displayed which includes reasonable excuse.

If you do not tick the check box or for whatever reason HMRC still send you a penalty even though you have ticked the check box and selected reasonable excuse, then do not panic.

Online filers are able to appeal online against a late filing (or late payment) penalty, using HMRC’s PAYE Online for employers service. Once you have logged in, select Appeal a penalty.

From the options you are given (A-H), option G is the one to use if you think you have a reasonable excuse.

HMRC have suggested that they will accept reasonable excuses from late filing or late paying taxpayers who are generally compliant without further investigation.

You can also send a late filing appeal in writing to:

National Insurance Contributions and Employers Office

HM Revenue and Customs

BX9 1BX

You can send a written appeal against a late payment penalty to:

DM PAYE Late Payment Penalties

HM Revenue and Customs

BX9 1EW

Note – DM stands for Debt Management.

Inaccuracy penalties

If you do not agree that there has been an inaccuracy, you should tell the HMRC officer you have been dealing with so they can consider the position.

See HMRC's factsheet on penalties for inaccuracies in returns and documents for more information.

Recovery of underpaid tax

Where an employer fails to operate PAYE correctly, for example by using the wrong tax code, and this results in an underpayment of tax, HMRC can either recover the tax from the employer or from the employee. In the first instance, HMRC should usually attempt to recover the tax from the employer before trying to contact the employee.

As such, having quantified the tax underpaid, HMRC should issue a notice to the employer under Regulation 80 of the PAYE Regulations. The employer has a right to appeal this determination if they think it is incorrect but if no appeal is lodged, the determination becomes final and conclusive within 30 days.

If HMRC recover tax from you, our understanding is that you may then have a right of action against the employee, however you would need to seek legal advice on this.

If HMRC are satisfied that the employer took reasonable care to comply with the PAYE Regulations and any underpayment of tax arose due to an error made in good faith, HMRC will instead seek recovery of the tax from the employee.

HMRC will also seek collection of the tax from the employee if they have reason to believe that the employee accepted their earnings in the full knowledge that the employer had under deducted tax.

Other information

We talk about what to expect if you get your worker's tax status wrong on our dedicated page.

You can also find specific guidance if you have got things wrong on our Minimum Wage and Auto Enrolment page.

For information on getting things wrong with the Coronavirus Job Retention Scheme, see our dedicated page.