What are the proposed Scottish income tax rates and thresholds for 2020/21?

The Scottish Government has proposed the rates and thresholds for Scottish income tax that will apply to the non-savings and non-dividend income of Scottish taxpayers from 6 April 2020. These are subject to approval by the Scottish Parliament, which we expect in March 2020.

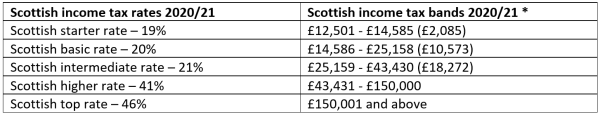

The proposed Scottish rates and bands for income tax from 6 April 2020 are set out below:

* The bands assume the UK-wide personal allowance for 2020/21 will be £12,500

These rates and bands apply only to the non-savings and non-dividend income of Scottish taxpayers. There is more information about who is a Scottish taxpayer in the ‘tax basics’ section of this website, but in essence, if your home is in Scotland for more than half of a tax year, you are a Scottish taxpayer. As a result, these rates and bands affect people who live in Scotland, if they have profits from rental property or if they have earned income, such as employment income, pension income and profits from self-employment.

Scottish taxpayers continue to pay income tax according to the UK rates and bands of income tax on their savings and dividend income.

While the first year of Scottish income tax (2017/18) brought only a minor change in comparison to UK income tax, with a difference in the higher rate threshold, since 2018/19 there has been a significant difference in the structure of income tax in Scotland.

In the first place, Scottish income tax has a five-band structure, with the basic rate band having effectively been split into three – the starter, basic and intermediate rate bands. Secondly, the highest rate of tax is called the top rate, rather than the additional rate. Thirdly, the higher and top rates are each one percentage point higher than their UK equivalents, at 41% and 46% respectively.

The proposed bands for 2020/21 assume that the UK-wide personal allowance for 2020/21 will be frozen at £12,500 – the Scottish Government made this assumption on the basis of commitments made by the then UK Government in the UK Autumn Budget 2018.

Once both the Scottish and the UK income tax rates and bands for 2020/21 have been confirmed, we will publish a news article to explore what this means for Scottish taxpayers.

Who collects Scottish income tax?

Although the Scottish Parliament sets the rates and thresholds for income tax payable by Scottish taxpayers on certain types of income, HM Revenue & Customs (HMRC) continue to collect and administer all income tax. This means that if you have any questions about your income tax, you should contact HMRC.

If you are a Scottish taxpayer and have PAYE income from an employer or a pension provider, you should have a Scottish PAYE tax code (an “S” code).

We will update our guidance in respect of the new rates and thresholds of Scottish income tax, and this will appear in our ‘tax basics’ section in April 2020.

Important

It is important to make sure that HMRC have your correct and up-to-date address. This is not the only factor in determining Scottish taxpayer, but it will be decisive in many cases. You can tell HMRC your up to date address using their online service.

Joanne Walker