Student loan repayments

This page explains how and when you make repayments on your student loans via the tax system if you are on Plan 1, Plan 2 or Plan 4 income-contingent loans.

Content on this page:

Repaying Plan 1, Plan 2 or Plan 4 student loans

The mechanics for how and when you repay your student loan are the same whether you have a Plan 1, Plan 2 or Plan 4 loan. If you are unsure which loan plan you are on then we cover the general rules on our page on student finance and the tax system or you can contact the Student Loans Company (SLC).

Note: if you had a Plan 1 loan awarded by the Student Award Agency for Scotland (SAAS), these loans were transferred to Plan 4 in April 2021.

Repaying other types of loan

If you are repaying a postgraduate loan, your repayments are calculated and repaid differently to Plan 1, Plan 2 or Plan 4 loans. See our page on postgraduate loans for more information.

If you are outside the UK for more than three months, you may have to make repayments directly to the SLC. We cover this on our UK student loan repayments when going overseas page.

Starting Plan 1, Plan 2 or Plan 4 repayments

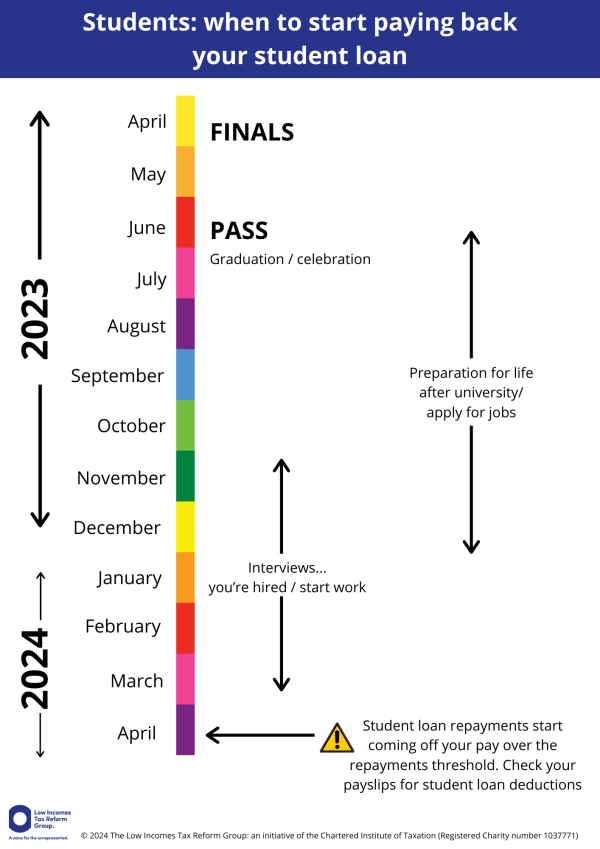

You will usually start repaying your loan at the start of the tax year after you finish or leave your course. For example, if you completed your course in June 2023 then the first student loan repayment would start to be deducted in the following tax year, 2024/25, so from April 2024.

But repayments only start if you earn over the ‘repayment threshold’. Your earnings are calculated before taking off tax or National Insurance contributions (NIC) or pension contributions.

The repayment threshold is different depending on whether you have a Plan 1, Plan 2 or Plan 4 loan. Under the next heading, we explain about the different repayment thresholds.

Our page repaying more than one student loan covers how repayments are calculated if you have more than one Plan 1, Plan 2 or Plan 4 loan.

Calculating student loan repayments

In very basic terms, Plan 1, Plan 2 and Plan 4 loan repayments are due at a rate of 9% on:

- your earnings over the repayment threshold per tax year, whether from employment or self-employment; and

- other income over £2,000 a year if you are required to fill in a tax return under self assessment and have total income above the repayment threshold. Please note the £2,000 threshold is ‘all or nothing’ so if you have other income of up to £2,000 in total in the tax year it is not taken into account at all, but if you have more than £2,000 the whole amount is included when calculating your repayment.

The repayment threshold usually changes each tax year and differs for each plan type as set out below.

Plan 1 loans - repayment threshold

- 2024/25 tax year (to 5 April 2025): £24,990.

- 2023/24 tax year (to 5 April 2024): £22,015.

Plan 2 loans – repayment threshold

- 2024/25 tax year (to 5 April 2025) and 2023/24 tax year (to 5 April 2024): £27,295.

Plan 4 loans – repayment threshold

- 2024/25 tax year (to 5 April 2025) is £31,395.

- 2023/24 tax year (to 5 April 2024) £27,660.

Repaying Plan 1, Plan 2 or Plan 4 loans through the tax system

There are three ways of repaying:

- through your wages, under Pay As You Earn (PAYE)

- through HM Revenue & Customs’ self assessment system

- direct to the Student Loan Company (SLC).

How do you know which one (or more than one, in some cases) applies to you? Use the table below as a guide.

| Would you answer ‘yes’ to the questions below? | Then your student loan will be repaid by: | |

| Are you employed in the UK? | → | PAYE |

| Are you self-employed in the UK? | → | Self assessment |

| Do you have other income (for example rents) and HMRC ask you to fill in a tax return? |

→ | Self assessment |

| Are you employed and self-employed? | → | PAYE and Self assessment (but you don't pay twice – sums taken under PAYE come off your self assessment bill) |

| Are you going or have you gone abroad? | → | Direct payments to the SLC |

| Have you nearly repaid your loan in full? | → | Possible opt out of PAYE deductions and switch to a direct debit to the SLC |

| Do you want to make extra payments direct to the SLC? | → | Direct payments to the SLC Caution: warning below* |

*If you make voluntary or extra payments to the SLC, this does not reduce any amount that you might owe under PAYE or self assessment. Instead, you pay off your loan faster.