The loan charge – here’s how to deal with it

Now that the loan charge has come into effect, it is time to look at some of the practical considerations around reporting and paying the loan charge. If you are on a low income, there are a number of steps you still need to go through between now and the 31st January 2020, even if you don’t think you will be able to afford to pay what you owe. We explain the steps in this article.

Content on this page:

Note this article is aimed at ‘contractors’ who were in employment-based umbrella company loan arrangements where the employer is offshore, or where the employer no longer exists. (The term ‘contractor’ applies to agency workers as well as higher paid temporary workers, e.g. IT freelancers that you might more typically associate with the term.) Those with employers who are onshore and still in existence or who were in trade-based schemes, should read our article on AccountingWeb.

HMRC have published guidance on the loan charge. This is regularly updated to try and keep it as clear and easy to understand as possible and so that it reflects the current position. We recommend that you check back regularly to GOV.UK for any updates.

Recap

The loan charge brings into the charge to tax all outstanding amounts of any ‘disguised remuneration’ loans made since 6 April 1999.

Put simply, in the absence of any action taken to ‘settle’ your tax affairs beforehand, HMRC will treat an amount equal to the value of all outstanding loans as income arising on 5 April 2019 – the tax on these amounts is the loan charge.

If you are not already in the settlement process, it is almost certainly too late to settle under HMRC’s November 2017 settlement terms. HMRC will consider truly exceptional extenuating circumstances but you should assume they will not extend those terms. If you are already in the settlement process then your HMRC contact will explain what, if any, further steps are required from you towards completion.

If you aren’t in the ‘November 2017’ settlement process, then HMRC remain happy to settle with you but the better November 2017 terms won’t be available to you. However there could still be a few ancillary benefits to settling outside the November 2017 terms depending on your circumstances (such as that you may not need to complete the 30 September reporting requirements discussed below). You should contact the HMRC loan charge team ASAP on [email protected] or 03000 599110 if you want to explore this further.

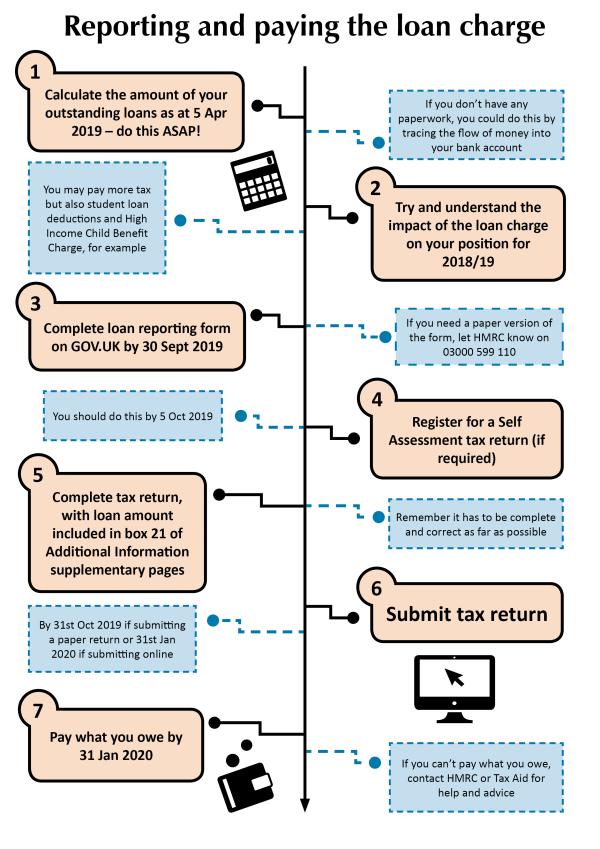

For everyone else, we have produced a very simple chart setting out to correctly report your outstanding loans and pay the loan charge. You can find more information and explanation around each of the steps below.

Calculating the amount of outstanding loans

To calculate the amount of your outstanding loans, you should check any pay documents, payslips or other paperwork you received for work performed whilst using loan arrangements.

HMRC understand that some people did not even know that they were in a loan scheme and so will not know the amounts that they received in loans. They should also appreciate that paperwork may only have been provided online – and could therefore be locked away in systems or platforms that you can no longer access.

In these circumstances, you should do everything you can to determine the amount you received in loans. For example, by trying to contact the umbrella company (or even the recruitment agency – who might be able to point you in the right direction) or by looking at the flow of money into your bank account. You should be able to get historic bank statements from your bank or building society or, as a minimum, banks should be able to provide a list of amounts you received from a particular employer. If you have online banking, statements going back several years can usually be accessed easily and for free.

If you go down this route, you should remember that the amount into your bank account will already be net of any scheme expenses – for example, any umbrella company fees. HMRC will only expect you to account for the net amount (which is of benefit to you as normally such fees are not tax deductible), but you should make sure you do not deduct them again!

How much tax will be payable?

The amount of outstanding loans will be put together and taxed as employment income all in one year (2018/19), so the total will be taxed at your marginal tax rate (s). As the amount is assessed in one lump sum, it will benefit from only one year’s worth of allowances and tax bands despite the fact it may have arisen over several years.

A small silver lining is that you won’t have any National Insurance to pay on the amount of outstanding loans – National Insurance would have been due had the earnings been paid to you properly (that is, as employment income under Pay As You Earn), in the first place.

To get a better understanding of what all this might mean for you, see the examples that we put together for a previous news piece, which examine likely loan charge figures across a number of different scenarios.

You can get a rough idea of how much you will owe in total in 2018/19 by using HMRC’s tax checker – make sure you select the 2018/19 tax year, include all of your income (not just the loan amount) and click through to the full tax calculation on the results page.

What else will the income count for?

Under the loan charge, you are considered to have received extra employment income in 2018/19, and a higher amount of income may mean things like the high income child benefit charge have to be paid, and could stop parents from opening tax-free childcare accounts. In addition, it could also trigger higher rates of tax and student loan repayments and cause loss of the personal allowance.

Our understanding is that the loan charge should not be counted as income for tax credits and universal credit and certain other means tested benefits but you may wish to double check the exact rules for the benefit(s) you are on with a welfare rights organisation, such as Citizens Advice.

Reporting requirements

If the employer you were working for when you got the loans is either offshore or no longer exists, you must deal with the reporting requirements yourself.

You must report details about the outstanding loans to HMRC by 30 September 2019. This can be done using an online form on GOV.UK (a paper version is available from HMRC on 03000 599110). If you do not do this, or the information is not complete and correct, you may be liable to penalties. Our expectation is that penalties will only be charged in the most serious cases but, strictly, anyone who does not report the loans by 30 September could be liable.

Separately, you must also include the amount of the outstanding loans in a 2018/19 Self Assessment tax return. HMRC will be undertaking a check and balance exercise to ensure that it has received the correct loan charge ‘returns’ from the people it expects to get them from (HMRC have wide information gathering powers and are aware of most loan activity so not doing anything is likely to cause serious problems for you in the long run).

Even if a taxpayer pays the loan charge, HMRC can continue with any open enquiry or assessment of earlier years. There are specific rules so that ultimately, there will be no double taxation, but you will have to pay the highest total amount due whether that be the amounts assessed for earlier enquiries (including interest) or the loan charge amount.

Completing your tax return

The total of outstanding loans should be reported in the SA101 Additional information supplementary pages, box 21 on the paper form (the online form boxes may be slightly different).

If you’ve not already registered for Self Assessment then you will need to by 5 October 2019 before you can complete a tax return.

You can find the form you need to do this (SA1) on GOV.UK. Please note that if you want to file your tax return online, you will have to set up an HMRC online Self Assessment account as a separate step, this process can take a few weeks.

Remember that in addition to reporting your outstanding loans, you must also complete the rest of the tax return. Even if you only have to complete a return because of the loan charge, you must also include any other income (and taxes paid) in 2018/19, as it is a ‘return’ of all of your taxable income for the year.

The submission deadlines are as follows:

- paper tax return is 31 October 2019

- online tax return is 31st January 2020.

A really key point to take away is that it is vital that you complete and submit a tax return even if you do not think you will be able to pay what you owe. This is because if you do not, you may be liable for failure to notify or late filing penalties, on top of what you owe, which will only serve to make matters worse.

The loan charge will be payable in line with the normal tax return process – meaning any tax due will need to be paid by 31 January 2020. Provided any tax is paid by this date, there will be no interest or penalties.

It is important to note that payments on account (POAs) for 2019/20 may be calculated in the tax return based on the loan charge. As this is a one-off charge, a claim may need to be made on the tax return to reduce the POAs.

If you have paid an APN for a tax avoidance scheme covered by the loan charge (an ‘accelerated payment notice or ‘APN’ asks you to pay an amount of tax upfront in respect of a dispute), HMRC will offset it against your loan charge bill. This can be done formally, where you waive your right to repayment of the APN and ask for it to be offset, or informally, where this offset will only be valid until any appeal against the APN is resolved.

To give effect to this through the tax return, it looks like you will need to enter the amount of the APN in box 15 of the supplementary Tax Calculation Summary, along with a note in box 17 giving details including the name and Scheme Reference Number (SRN) of the scheme the APN relates to – again, these numbers relate to the paper form. We understand that HMRC will confirm exact instructions on the offsetting of APNs in due course.

If you only need to complete a 2018/19 tax return, because of the loan charge, then you should consider whether you need to submit them on an ongoing basis. If you do not, you should ask HMRC to close down your Self Assessment record, otherwise they will keep sending you tax returns to complete.

But what if you can’t pay what you owe?

You may already have a rough idea of what you owe HMRC and know that you will not be able to pay - on time or at all. If this is the case, you should contact HMRC as soon as you can to discuss your situation and to arrange an extended payment plan. In the first instance, and even if the loan charge makes up only a part of what you owe, we suggest you contact the specialist loan charge team on [email protected] or telephone 03000 599110.

If you leave things until after the 31st January 2020 and miss the payment deadline, you may have to talk with HMRC’s Debt Management team directly to arrange a more formal ‘Time to Pay’ arrangement.

HMRC have indicated to us that some of the flexibility around payment arrangements that was made available to those settling under the November 17 terms, will be made available to those who face the loan charge. However, at this stage, this does not seem to include any ‘no questions asked’ payment plans. HMRC will instead consider cases on an individual basis based on your specific circumstances – there is no upper time limit on how long payments can potentially be spread. You should be aware that HMRC may not agree to any kind of long term instalment arrangement, if, for example, there are assets you could sell or other ways of raising the money more quickly.

You should also be aware that any payment arrangements made with HMRC carry ‘forward interest’ – which is the normal interest rate plus 1%. The 1% is to compensate HMRC for the extra risk and cost involved in an extended payment period. This is not a specific charge to those facing the loan charge, and HMRC has no discretion here. It is obliged by law to charge interest and cannot reduce or ‘freeze’ the interest to help you.

More broadly, however, HMRC should deal with loan charge cases in line with their general debt strategy, which means that identified vulnerable taxpayers will be given special consideration, which could include being passed over to HMRC’s Needs Enhanced Support team. Vulnerable taxpayers could potentially include those on low pay who were ‘passive’ users of loan schemes, that is, people who may not have really understood what was happening with their pay and taxes or who had little choice but to join schemes if they wanted to work.

You need to be open about difficulties you are facing when dealing with HMRC, so that they can both assess whether you need that very specialist help and to understand more generally if there are particular issues of yours which they need to take into account when helping you to resolve your loan charge and/or overall tax position.

What other options do I have?

We know that there are many people talking online about bankruptcy in connection with the loan charge and that this can sound very scary. An earlier HMRC publication sets out their position on bankruptcy and not forcing someone to sell their main home to pay the loan charge.

To be clear: HMRC will only pursue bankruptcy as a very final option where you owe them more than £5,000, there are valuable assets that could be used towards payment of the debt and they have just been unable to come to any other reasonable arrangement with you.

So, some people who are facing huge loan charge bills could end up in bankruptcy – this may be as a result of HMRC petitioning for bankruptcy (in exceptional cases as explained above) or this may be initiated by taxpayers themselves, because they are insolvent and want a fresh start. You can read more about bankruptcy as an option on TaxAid’s website.

For homeowners, HMRC will not force the sale of the main home but may consider putting a legal charge on a property, which means that the debt is repaid when the house is sold. Again, these arrangements are only used as a last resort in very specific circumstances.

Very occasionally HMRC may decide not to pursue payment of the loan charge. This is sometimes known as remission. The tax is not permanently written off, but you will not receive further demands unless your circumstances improve unexpectedly. Remission is most common in the case of a person who is elderly, sick or long-term unemployed, and has no assets and lives in rented accommodation. If you think you might be eligible for remission, TaxAid can help you put your case to HMRC.