Personal allowance

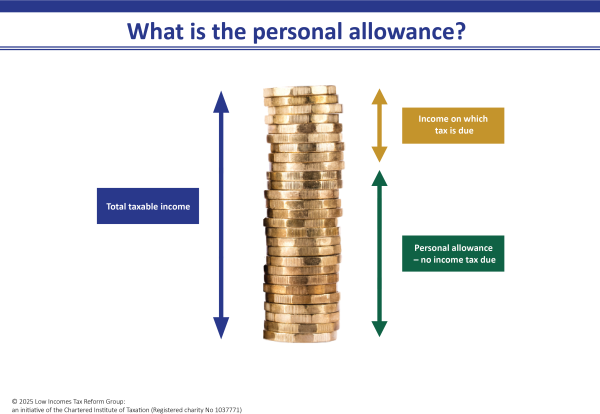

The personal allowance is deducted from your taxable income before income tax is calculated. It can therefore reduce the amount of income tax you pay. The personal allowance means that you can have a certain amount of taxable income each year without paying tax.

Content on this page:

The personal allowance

The personal allowance is a tax allowance that is available to most people who are resident in the UK and some who are not resident in the UK. There is more information on who is eligible for the personal allowance on our page Tax allowances.

The personal allowance reduces the amount of taxable income on which you pay tax.

Taxable income which is not actually taxed because of the personal allowance is still taxable income. Using the personal allowance against this income does not make it tax-free, it just means that you may not have to pay tax on that part of your income. This is important, because means-tested benefits often consider whether income is taxable when determining what income is taken into account.

Income below the personal allowance

If your income is below your personal allowance, meaning you do not make full use of your personal allowance, you lose the benefit of the unused part.

However, you can choose to give up part of your personal allowance to give your spouse or civil partner a reduction in their tax bill. This is known as the marriage allowance (transferable tax allowance for married couples and civil partners).

You cannot carry any unused personal allowance backwards or forwards to a different tax year.

How to use the personal allowance

Different types of income can be taxed differently. When deciding which type(s) of income to deduct the personal allowance from, you can do this in such a way as to minimise your tax liability.

It is usually best to use your personal allowance against earned income or non-savings income first, but this is not always the case. If you have savings income and dividend income, as well as earned income, it may be best to set your personal allowance against your earned income and your dividend income, before your savings income.

Equally Scottish taxpayers may find it beneficial to set some of their personal allowance against savings income, to make best use of the Scottish starter rate of 19%.

You may have to contact HMRC to ask them to allocate the personal allowance according to your wishes.