Disguised remuneration

Disguised remuneration (DR) is where you are paid a minimum wage element and a non-taxable element like a loan, grant, advance etc by an umbrella company. DR is not compliant with tax law, as all money paid to you in return for your services should be subject to PAYE income tax and National Insurance contributions (NIC). You need to make sure your umbrella company is not using a DR scheme to pay you.

Content on this page:

Why umbrellas use DR

Umbrella companies are unregulated and there is a wide spectrum of operators in the marketplace. Most umbrella companies are compliant and don’t get involved in DR schemes, but some do (and some have been specifically set up for this purpose).

Sometimes these umbrellas may try and ‘sell’ DR to workers as a way to increase their take home pay. They may simply frame things in terms of you receiving an unrealistic amount of take-home pay – 80%, 85% etc. Other times they may use DR to pay their workers without making it clear that they are doing this. In these instances, you may not benefit at all, or you may only benefit by a small (probably unnoticeable) amount. DR can make tax savings/reduce costs for the umbrella and others in the supply chain so there is a benefit to them of doing this. In this guidance, we look at both scenarios.

What the law says

Some non-compliant umbrella companies pay people using non-taxable payments, often routed through a third party like a trust. But if payments are routed through a third party like this, they are very likely to fall foul of a very substantial suite of anti-avoidance legislation that we have, called the 'disguised remuneration' rules.

Some non-compliant umbrella companies major on the fact that the non-taxable payment isn't routed through a third party and so doesn’t fall foul of the special disguised remuneration rules.

That may be correct but what they fail to mention is it is highly likely to be employment income under general principles – the charging provision for employment income is very wide indeed. The legislation defines “earnings” as:

- any salary, wages or fee,

- any gratuity or other profit or incidental benefit of any kind obtained by the employee if it is money or money’s worth, or

- anything else that constitutes an emolument of the employment.

Why umbrellas sell DR

Often legislation can be open to interpretation. HMRC administer the tax law; they do not make it. While HMRC may issue descriptions of how they view the law and intend to apply particular legal provisions, taxpayers (including umbrella companies) are free to interpret the law in a different way.

So, in the case of a loan, grant etc. paid directly from an umbrella company to a worker for example, the umbrella company may think that they have a good argument that it is not caught under the definition of earnings. HMRC may think that because it is a payment of money that stems from an employment, it is very clearly caught.

Ultimately, such different interpretations will only be resolved if they are tested in the courts, which then must interpret the words in the statute and decide what they mean.

It can take a very long time for cases to be heard in court, and (even if the case is bound to fail) in the meantime, there is a cash flow benefit for the umbrella company.

Furthermore, in the event that the case fails, even though the PAYE regulations say that in most circumstances an employer should remain liable for the tax that should previously have been accounted for to HMRC, sometimes, HMRC pursue the worker instead (more on this at the end of this page).

Risks to workers of choosing a DR scheme

We would have thought it very likely that a court would disagree with any argument which says that something like an investment payment does not count as employment income (even if the umbrella company has a KC's opinion saying otherwise!). As stated above, where they win a case, HMRC can pursue workers for any tax that is owed.

Alternatively, where usage of certain schemes becomes widespread, rather than try and tackle schemes through the courts, HMRC can also ask the government to tighten up the legislation to address the tax loss. It is extremely important to note that this can be done with retroactive effect, which is what happened with ‘disguised remuneration’ schemes and the loan charge.

So, if you use such a scheme, one way or another, you will likely end up with a bill for any back taxes owed, including interest on tax paid late and possibly a penalty. Remember that HMRC can often go back and look at your tax position for many years, so it can be very expensive. Having HMRC pursuing you for tax can also be intrusive, lengthy and stressful and can have a devastating impact on you and your family.

If you need any further persuading, consider the fact that many umbrella company workers who used loan schemes in the past, are now having to deal with the ‘life-changing’ loan charge.

HMRC publications

HMRC have issued lots of publications in the last year or so on DR, including:

- Spotlight 60

-

Spotlight 60 – Warning for agency workers and contractors employed by umbrella companies. Find out about the tax avoidance arrangements used by some umbrella companies.

- Risk checker tool

-

Risk checker tool – Find out how to check your risk of being involved in tax avoidance if you're an agency worker or contractor working through an umbrella company.

- Payslip checker page

-

Payslip checker page – If you're a contractor or agency worker, find out how to check your payslip to make sure you are not involved in a tax avoidance scheme, operated by some umbrella companies.

- Toolkit

-

Toolkit if you’re a contractor, agency worker, or work through an umbrella company – Find out how to spot the signs of tax avoidance, report avoidance, or get help leaving or reporting a tax avoidance scheme.

- Naming list

-

Naming list – Information about tax avoidance schemes, promoters, enablers and suppliers of these schemes (many of the names are umbrella companies).

All the HMRC publications linked to above are focussed on trying to tackle DR by raising awareness of the risks and changing taxpayer behaviour. This is based on an underlying assumption that the key driver of DR ‘usage’ is individual taxpayers actively seeking tax avoidance opportunities to increase their take home pay.

As set out in the introduction, the key thing to understand about DR, which isn’t really made clear in any of the HMRC publications, is that in some instances DR may benefit the umbrella companies but have no (or negligible) impact on a worker’s take home pay. This means you may have no knowledge whatsoever that you are being paid in a non-compliant way. The rest of this page, concentrates on this scenario.

Being paid through DR without knowing

Traditional, compliant, umbrella companies pay out the vast majority of the income they receive from agencies or end clients, in the form of worker salaries and ‘on top’ employment costs (such as employers’ NIC), with the company retaining a small ‘margin’ for its services.

By using a DR scheme, the umbrella company can increase its profitability very easily and/or pass this money to others in the supply chain to secure future business.

What to look out for

Some possible signs of DR are:

- Arrangements that offer to let you keep more of your pay than you normally would

- A contract of employment showing that you’ll only be paid the national minimum wage (NMW), when you know you’ll be paid more than that

- An agreement where you get payments that you are told are not taxable

- Receiving more than one payment into your bank account each pay period

- Confusing or unclear paperwork (contract/payslips etc.) – or none at all

- Not receiving a payslip or receiving a payslip that shows a different ‘net’ amount to what you actually received

- Information in your HMRC personal tax account (or on the HMRC App) about your pay and taxes that does not match what you are being paid

You need to be extra vigilant if your existing umbrella company changes hands or gets taken over as we have heard of a problem where a compliant umbrella was taken over by one running a DR scheme behind the scenes, which the workers were put into unknowingly. An indication that this may have happened is if your employer’s name or PAYE reference number changes (your PAYE reference number looks something like this 123/A1234 and is usually shown on your payslip).

HMRC early intervention work

As part of HMRC’s work to try and clamp down on the problem of DR, they are writing out to workers that they think are in DR. This may be based on the payroll data that the umbrella company sends into them each time you are paid – the payroll data might look unusual, such as where an entire workforce has been paid only the NMW.

You may not have realised that you were being paid through a DR scheme if all you do each week is check that your net pay looks roughly the amount you were expecting. But DR is a serious issue, and now that you have received this letter from HMRC, you need to check if there is a problem in the way that you are being paid.

First, you should check all documents relating to your employment arrangements. You should look for anything that suggests you are paid in payments that are ‘not taxable’ or that are not treated as earnings (for example, loans, grants, annuities, shares, advances, investment payments, credit or other payments).

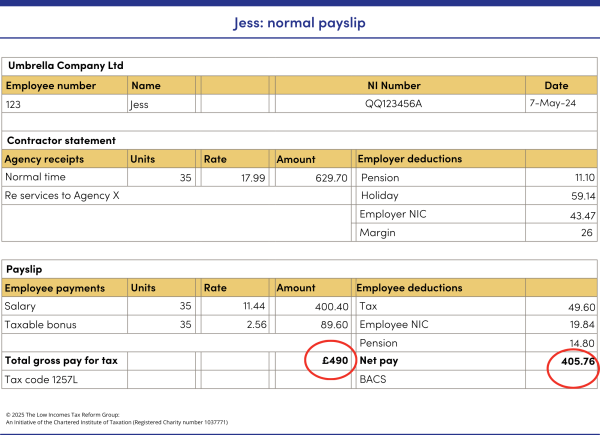

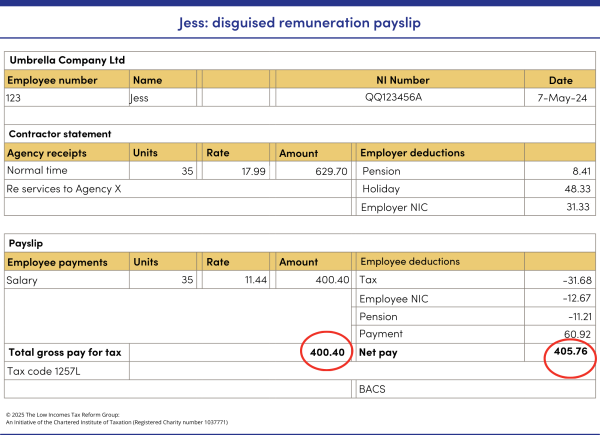

Then you should think about your payslips. Although you may not have received payslips at all, if you did (and you can access them), they may show that you only received the NMW, they may show a different ‘net’ amount to what you received in your bank account, or they may show a lower gross pay for tax amount than net pay amount (as per the DR payslip in the example above).

You should also check your bank statements and see if you received more than one payment into your bank account – in the example above, she received a larger amount (the normal taxed amount) and then a smaller ‘top up’ amount separately, although this might not always happen.

You should also check other sources for information or clues as to their pay practices – for example you could check the umbrella company’s website or social media, look up other websites (sites like Contractor UK have forums where people post useful information and warnings about DR schemes) and look for news and/or recent events about the umbrella company.

You may have found the letter alarming, but HMRC want to let you know as early as possible where they believe that you are involved in a tax avoidance scheme. This is so you can get out of the scheme before the problem grows.

What happens if you are in DR unknowingly

Being paid through a DR scheme means that you will not have paid enough tax on your total earnings. Depending on how long you have been in the scheme, a significant underpayment may have built up.

HMRC’s guidance and communications sometimes suggest that it is you that could end up having to pay this back. However, while there is, indeed, a concept in UK tax law, that people are responsible for their own tax affairs, this is not generally the case where they are employed and have their income tax collected via the PAYE system by their employer.

What underlies a DR scheme is a failure to operate PAYE correctly on behalf of the umbrella company employer. In law, the PAYE Regulations say that HMRC can collect tax underpayments from the employer (Regulation 80) – this is effectively a means of enforcing the payment of PAYE and says that the employer will remain liable for the tax that should previously have been accounted for to HMRC but for whatever reason was not paid.

There is an alternative route open to HMRC to transfer the tax liability to the employee. However, this is restricted to cases satisfying either of two conditions (Regulation 72):

- that the employer took reasonable care to comply with the PAYE Regulations and its error was made in good faith, or

- that the employee had received relevant payments knowing that the employer wilfully failed to deduct the amount of tax that should have been deducted from those payments.

Finally, the employee can also be directed to pay the liability where the employer cannot pay the amount from the determination (because for example they are insolvent or have ceased trading) but only where one of the two conditions is met (Regulation 81).

Please note that in addition to this, HMRC have discretionary powers to disapply the PAYE regulations, but we do not think they would apply in situations where workers have been paid through DR unknowingly.

All of this means that we wouldn’t expect to see workers being chased for any underpaid PAYE without HMRC first trying to engage with the employer.

Note that if HMRC take that action against an employer, our understanding is that in most cases, the employer will then have a right of action against the worker which – if successful – will end up with the worker being in the same position as if the correct deductions had been made in the first place. However, we do not think it is for HMRC to make a shortcut straight to the employee – the PAYE regulations must be applied and then it is up to the employer to take any action against the employee that they see fit.

Indeed, HMRC’s own internal guidance requires them to look first for ‘employer error’ and it is worth quoting the following passage if necessary: PAYE90020 – Reconcile individual: underpayments: PAYE directions ‘If an employer fails to deduct the correct amount of PAYE from an employee’s earnings, the employer is liable for the amount under-deducted. The underpayment should be recovered from the employer not the taxpayer, unless HMRC makes a PAYE direction.’

If you need help dealing with HMRC on this issue, you should seek assistance from a professional adviser, or if you are on a low income, TaxAid.