Capital gains tax on gifts

If you give an asset to someone, you may have to pay capital gains tax (CGT), as you are disposing of something. The rules depend partly on who you make the gift to. For this purpose, a gift includes selling something for less than its market value.

Content on this page:

Gift to a spouse or civil partner

As a basic principle, you do not pay CGT when you make a gift to your husband/wife or civil partner as long as both of the following apply:

- you are living together as husband and wife/civil partners (but see below about gifts made following separation)

- the gift is not of ‘trading stock’ (trading goods bought for resale)

However, the recipient of the gift will take on your original purchase cost of the asset. This means if your husband, wife or civil partner later sells or otherwise disposes of the asset, they will have to pay the tax on any gain made over the total period of ownership. In other words, the recipient spouse or civil partner is treated as having purchased the asset for the original cost paid by you (or value on 31 March 1982, if applicable) – not at the market value on the date they received the asset.

Gifts made during separation or divorce

If you are separated or divorced or your civil partnership has been dissolved, read our page on the CGT consequences of assets being transferred following the breakdown of marriage or civil partnership.

Keep records of what the asset cost you, as your spouse or civil partner may need this to work out their CGT when they dispose of the asset.

Gifts to other family members

When you make a gift of an asset to a family member or other person you are 'connected' with (as described below) – other than your spouse or civil partner as described above – you need to work out the gain or loss based on the market value at the time of the gift.

This also applies if you dispose of an asset to them in any other way, for example, you sell it to them for less than it is worth (in this case the actual proceeds you receive are irrelevant in calculating the gain or loss).

If you make a capital gain, you may have to pay CGT (though it may be possible to elect to pay this by instalments - see below).

If you make a loss on a gift you make to a connected person you can only deduct the loss from gains you make on gifts or other disposals to the same person. These are known as ‘clogged’ losses.

Connected person

You are connected to your spouse or civil partner (though see above regarding transfers between spouses and civil partners) and they are connected to you. In addition, you are connected to a relative, and they are connected to you, in any of the following cases:

- you are their direct descendant (your parents, grandparents, etc.)

- they are your direct descendant (your children, grandchildren, etc.)

- they are your brother or sister

- they are the spouse or civil partner of any of the above relatives

- they are connected to your spouse or civil partner

The above list includes those who have the same legal relationship to you by adoption – for example, your adopted son, or brother by adoption is connected to you in the same way as a biological son or brother.

It follows that you and your spouse or civil partner are connected to the same set of people. However, if A is connected to B, and B is connected to C, then it does not necessarily follow that A is connected to C. The relationship between A and C must be one of the above listed for A to be connected to C. Therefore, you are not connected to your aunts, uncles, nieces, nephews or cousins.

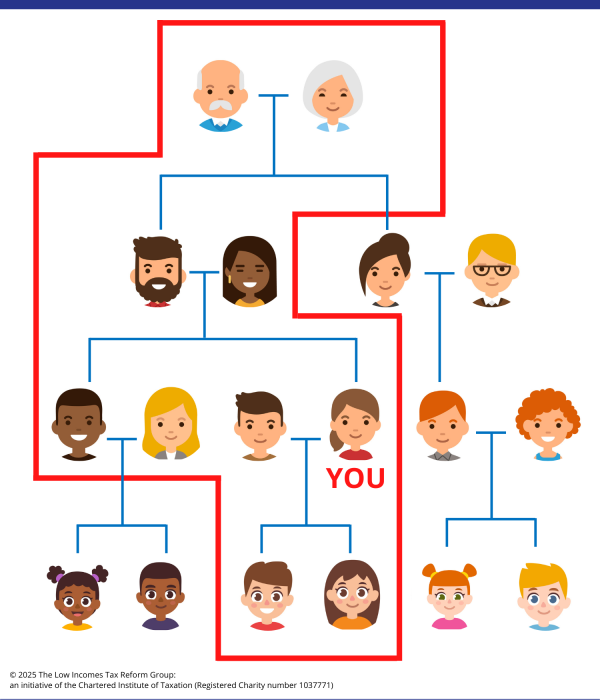

As an example, if your family tree is as follows then you are not connected to the relatives outside the red outline:

A connected person can also include either of the following:

- certain trustees

- a company you control

Valuation of assets

You must get a valuation of the asset at the time you made the gift and use this value in place of any amount you received for the asset – if it is a gift this would usually be nothing – to work out your gain or loss. You can agree the valuation with HMRC before you submit your tax return by completing form CG34.

Gifts to anyone else

If you make a gift to someone you are not connected to, such as a friend, or you sell something to them at less than market value, then you can still be treated as making the disposal at market value if the disposal is not at arm’s length.

In most instances, if you gift an asset to someone or you knowingly agree to receive less than market value for the asset by virtue of your personal relationship with that person, the transaction will not be considered as being at arm’s length (or to put it another way, it will not be a normal commercial transaction).

In this case, the actual amount paid (if anything) for the asset will be ignored and the market value will be used instead to calculate any capital gain arising.

The above is different to a commercial transaction at a reduced value. For example, to achieve a quick sale, you might sell a property to a property-buying company which offers you less than the full market value. In such a situation, the proceeds would be the actual amount you receive assuming you have no connection with the property-buying company.

Paying by instalments

If CGT is due on the disposal of certain assets – including land or a controlling holding of shares – by way of gift, then it may be possible to elect to pay the tax by ten equal yearly instalments. We discuss this in more detail at Capital gains tax reporting.

Other considerations

If you gift an asset to someone then you should consider whether there are any inheritance tax consequences. If the gift is not exempt for inheritance tax purposes and you die within seven years of making the gift, it may become chargeable to inheritance tax. See Inheritance tax for more information.

For gifts of property, such as a house, you might need to consider whether a stamp duty land tax charge arises (or land and buildings transaction tax in Scotland, or land transaction tax in Wales). This is payable by the purchaser/person receiving the gift. You should take professional advice.

If you gift business assets or shares in your own trading company, then you may qualify for relief from CGT on the transfer.

Relief is also available in respect of gifts to UK charities and certain other bodies.