OECD rules

Many people make a living from doing things in the gig economy like driving, delivering, or freelancing; often via online platforms such as Uber, Deliveroo and TaskRabbit. Some new HMRC rules came into force in January 2024, these are known as the OECD rules or digital reporting rules. The OECD stands for the Organisation for Economic Co-operation and Development. On this page, we explain more about these new rules and how they may affect people using online platforms.

Content on this page:

The most important thing to understand about these new rules is that they relate to reporting requirements between various online platforms and HMRC. They do not create new tax obligations for individuals – the rules about who needs to declare their income, who need to register for a self assessment tax return, when to register and how much tax people must pay in relation to their activity are already in place and have not changed.

New digital reporting rules

From 1 January 2024 new OECD rules apply which require UK-based online platforms to:

- From 1 January 2024 - collect information about people who make money through their platforms over a calendar year and

- On or before the following 31 January (i.e. 31 January 2025 for the period 1 January 2024 to 31 December 2024) - send this information to both HMRC and to the individuals themselves.

The information concerned largely relates to the identities of people and the money that they make through the particular platform. We explain who is affected by the new rules under the heading Online platform users and new OECD rules below.

Once HMRC have this information from the online platforms, they can exchange it with other tax authorities in foreign countries who have also signed up to the new rules. This means these overseas authorities should be aware of money that people who live in their country are making from UK platforms (and vice versa).

These new rules may make it easier for people who make money through online platforms to comply with their tax obligations as the platform operators must give them details of their earnings. This information may help them complete their tax returns for example. The information provided to HMRC about an individual’s earnings should help HMRC tackle non-compliance/tax evasion when individuals have not declared those earnings for tax purposes. However, there are some important points that people using these digital reports to complete their tax returns should be aware of and we explain more under the heading, Digital reporting and tax returns, below.

Online platform users and new OECD rules

People who make money (including tips/gratuities and incentives) through the online platforms that are impacted by the new rules will potentially be affected from 1 January 2024.

The new rules mean that if people have not been reporting their platform income properly and paying the appropriate tax in line with existing rules, then HMRC are more likely to find out about it. We explain about your existing tax responsibilities which have not changed because of these new OECD rules on our Gig economy page. They also mean that the online platforms might ask you more questions before they allow you to sign up to ensure they can collect the information about you that they are required to by HMRC.

The rules setting out which online platforms are impacted are very complex however the key points are that:

- The new rules will apply to UK-based platforms that help make transactions between sellers of goods and services and customers possible (except those that do not allow sellers to make a profit from the payments received, e.g. some ride-sharing platforms where the only money that changes hands is a contribution towards fuel).

- If you use platforms in other locations- although these will not be required to report for the purposes of the UK reporting rules, they may be covered by similar rules in another country that is implementing the OECD rules. This means HMRC could eventually have the same information about transactions once the overseas tax authority has sent the information to them.

The following transactions are captured:

- Category A - those to do with property rental, vehicle rental or a personal service

- Category B - those to do with the sale of goods - although not if you occasionally sell goods for small amounts. (This is defined as less than 30 transactions during the calendar year for which the total amount made must not exceed 2,000 euros - both tests must be met for this exclusion to apply.)

Category A captures things like taxi and private hire services, food delivery services, freelance work and the letting of short-term accommodation through online platforms. Category B captures people who buy or make purposefully to sell; but not those who sell a few personal belongings every now and again, for example to declutter.

Therefore people who make money via many different platforms, including the more well-known ones such as Uber, Deliveroo, Just Eat, Airbnb, TaskRabbit, Etsy and Ebay may all potentially be affected.

These new reporting rules will not affect all users of online platforms. However, it is still important to understand that even if your activity is not captured by the new rules, you still need to check your position, as the money you are making could still be taxable. In particular the following types of people probably still need to do something about their taxes:

- if you fall within the ‘small’ Category B exemption (see above) but are still trading;

- if you are paid outside the platform for some element of your work, perhaps in cash or in kind or gifts (as explained on our Social media influencers webpage);

- if you have a business commercially selling direct to the public in fairs and boot sales as well as through a platform (for example, if you had an old antique coin business);

- if the online platform account you work under is not in your name, but a friend or relative’s (meaning HMRC will think the income belongs to them!)

Digital reporting and tax returns

In general, as explained on our gig economy webpage, most people have to declare their income from the gig economy to HMRC and pay tax on any profits they make. If you have already been declaring your income, as required, then you don’t need to do anything differently. If you do not do this already, then you should take steps as soon as possible to bring your tax affairs up to date. Otherwise you could have a problem when HMRC receive data that they realise does not match what you have told them or you have not told them about your gig economy income at all. We look at this on our webpage, Gig work- what to do if you are behind on your taxes.

Selling goods and services

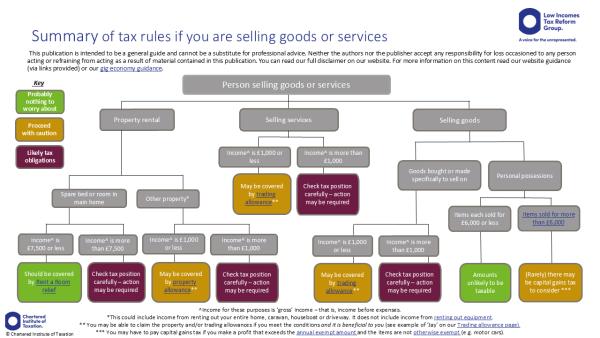

The flowchart below summarises the tax rules if selling goods or services.

As can be seen in the flowchart there are two main exceptions to declaring this income from selling goods:

- If you have total trading or miscellaneous income (before expenses are deducted) of up to £1,000 (the trading allowance) and meet the other conditions for the trading allowance to apply; or

- If are selling personal items that you no longer want or to clear some space (this is unlikely to be counted as trading or miscellaneous income so does not use up the trading allowance).

When you are selling things you no longer want, e.g. books, toys, clothes etc., the reality is you are generally selling at less than you paid for them. Your activity is unlikely to be regular, organised or developed and you are not operating with a view to making a profit if you are simply trying to get back some of the money you originally spent on those items. You are therefore unlikely to be trading, so even if it is a significant amount, any money you make is generally not taxable. We explain in what circumstances you are likely to be trading on our gig economy page.

In rare instances, if you sell high value personal items like jewellery and paintings you may have to report and pay capital gains tax. Broadly this only applies if you sell the item for more than £6,000 and you make a profit. Even if you make a gain/profit, you may not have to pay any capital gains tax as you get an annual exempt amount (£3,000 in the 2024/25 tax year). We explain more on our Selling shares and assets page.

For those who are trading or generating miscellaneous income, there are lots of misconceptions out there – that because it is a side hustle, or you are paid in cash, or you have been doing it for less than a year then you don’t need to worry about telling HMRC – none of this is true.

Some people also think that if you have no tax or National Insurance to pay, then you don’t need to submit a tax return. HMRC say that if you have self-employment income of more than £1,000 you need to send HMRC a tax return, even if there is no tax or National Insurance to pay. However, there is a view that if there is no liability to pay anything, there is no need to submit a return. Read our guidance here for more information. It is important to stress that if HMRC have asked you to complete a return, by sending you a notice, you will still need to complete one in these circumstances – even if you have no tax or National Insurance liability – unless the notice is withdrawn or cancelled.

Digital reports

The digital reports from the online platforms may be useful if you need to complete a tax return for income from selling goods or services using online platforms. However, there are some points you may wish to consider:

- The reports you receive from the digital platforms are for a calendar year and you must report your self-employment income and expense on a tax year (6 April to 5 April in the following year)

- You may not receive a report from all the online platforms you use. As explained under the heading Online platform users and the new OECD rules above, the platforms only need to report information if you sell above certain thresholds. However, if you need to complete a self assessment tax return for your income from using platforms then you need to include the total income from all your online trading and not just the income from platforms who provide you with a digital report.

- It is our understanding that there is no standardised way your digital report will be presented or sent to you. This means that each platform may provide the information in different ways, so you need to make sure you pick up the correct gross income and expense amounts from each separate report.

Checklist to prepare for the new rules

- Read our guidance - We set out the main tax obligations that people in the gig economy have, in our gig economy guidance. You may find our tax information on being an online trader and using platforms helpful too

- Check your position - To make sure that you have been doing everything correctly (and that you will continue to do things correctly!)

- Register for a 2023/24 self assessment tax return if you need to.

- If there are any earlier years that require regularising you may want to seek assistance – as we set out on our page, Gig work- and what to do if you are behind on your taxes. If you cannot afford to pay for a professional accountant or tax advice, TaxAid may be able to assist you with historic problems and get you compliant going forward.

- Put things in place now that will help you manage your tax position going forward. For instance, from a practical perspective, people who are doing a mixture of things (for example selling things to declutter and selling things they have bought or made specifically to sell on), may wish to try and manage the different strands of money separately to help keep themselves compliant. Using different online platforms is one way of doing this as it keeps everything neat and tidy. However, in reality, the UK tax system is a self assessment system, with the onus on you to factor in/report what needs to be factored in/reported. Provided you are keeping good records that clearly demonstrate the difference in the nature of the underlying items that are being sold and that explain inclusions and exclusions in your workings/reported figures - this should hopefully be enough.

We have more information on record keeping on our self-employment section. This page also covers what records you may want to keep if your income is below the trading allowance and you don’t actually need to complete a self assessment tax return.

More information

The new rules implement the OECD’s “Model Rules for Reporting by Platform Operators with respect to Sellers in the Sharing and Gig Economy”.

HMRC’s supporting technical guidance explaining the scope/definitions etc. of the new rules can be found on GOV.UK.