Gig work and the flat rate VAT scheme

This page provides further guidance on VAT for low-income workers. If, after reading this guidance, you decide you want to register for VAT, we would strongly recommend that you seek professional advice and assistance, due to the additional administrative obligations it would place on you. We publish separate guidance on finding a professional adviser.

Content on this page:

Introduction

If you work in the gig economy doing jobs such as a courier, delivery driver, taxi driver or something similar, you may have heard that you can charge more for your services if you voluntarily register for VAT, or that you can bolster your earnings under the Flat Rate VAT scheme.

However, VAT is a complex tax – any apparent ‘benefits’ there are of entering the VAT regime can be totally wiped out by accountancy fees, software to file your VAT returns under the Making Tax Digital regime or penalties for getting things wrong. Voluntarily entering the VAT regime is therefore not something to be undertaken lightly – especially if it’s only a short term or seasonal role!

VAT and gig work

Some gig work is advertised where the payment rate is quoted as an amount inclusive of VAT – for example, an advert may offer work for a delivery driver for £150 per day including VAT.

This is quite confusing and if you want to apply for such a job, you may have some questions in your mind, such as:

- Does it mean the true payment rate is £150, or something else?

- Will you get to keep the whole £150?

- Do you have to be VAT-registered to claim the £150 payment rate?

- Why does the job advert assume you will already be VAT-registered?

- Is the job advert just trying to disguise an otherwise lower payment rate?

Understanding how VAT works should help answer some of these questions.

VAT (Value Added Tax) is charged on the supply of goods and services by businesses (including people in business on their own account such as the self-employed) who are VAT-registered. You cannot charge VAT if you are not VAT registered.

There is detailed guidance on our VAT when running a business page which provides information on:

- when you MUST register for VAT (the turnover test),

- choosing to register for VAT voluntarily, and

- how VAT returns work and paying VAT.

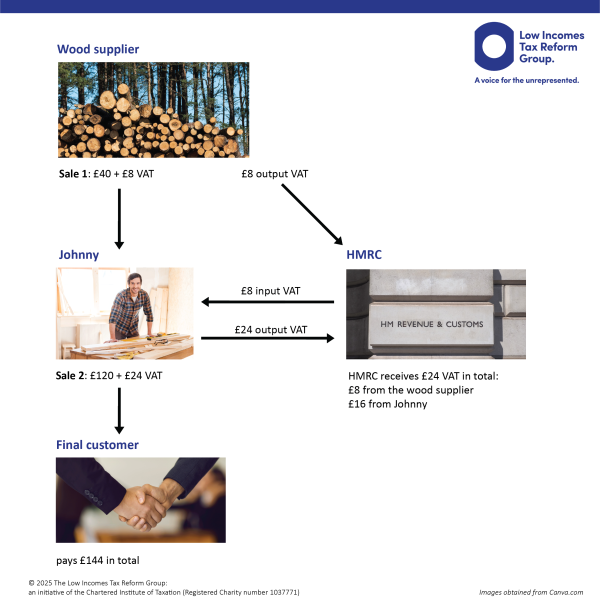

Each VAT-registered person in a supply chain between the first supplier and the final consumer, charges VAT on taxable supplies made by them to their customer(usually at 20%). If VAT is charged on taxable supplies made to them by their supplier (usually at 20%) then the difference between the VAT they pay out on supplies and the VAT they receive from their customers is paid over to HMRC, usually every three months. It is all accounted for by completing a quarterly VAT return.

The example below illustrates how VAT works.

VAT registration

We explain when you need to register for VAT on our VAT when running a business page.

From 1 April 2022 when you register for VAT you will automatically be registered for Making Tax Digital for VAT (MTD for VAT) too even though you may be exempt from MTD for VAT. Our page on Reporting and paying VAT explains what MTD for VAT is and who may be exempt.

Most gig workers, in business on their own account, will have total sales income well below the VAT registration threshold (£90,000 for 2024/25) and are therefore not required to register for VAT. If you are not registered for VAT, it means that you do not charge VAT on your supplies (output tax) and you cannot reclaim the VAT paid on your expenses (input tax).

However, when you are not VAT registered you get full tax relief for your VAT inclusive costs by claiming the total amount you have paid as a business expense in your self-employed accounts for income tax and NIC purposes.

If you are not VAT-registered, we assume that a delivery company offering their new drivers a rate of £150 including VAT, would only expect to get an invoice from you for £125 per day, being the amount before VAT is added (£125 + 20% of £125). If you are VAT-registered, then you must invoice the delivery company for the full amount of £150 (that is £125 + VAT of £25) but you should remember that you will need to pay some or all of the ‘extra’ £25 to HMRC.

Voluntary registration and the Flat Rate VAT scheme

You can choose to register for VAT voluntarily, that is, even if your income is not over the VAT registration threshold (£90,000 for 2024/25). If you also register for the simplified VAT scheme known as the Flat Rate Scheme (FRS), this can sometimes mean that some businesses can end up ‘in pocket’ (so making additional taxable income), depending on the nature of the business itself.

Under the FRS, a business charges VAT on its taxable supplies at 20% as usual but instead of paying over this ‘output tax’ less any recoverable ‘input tax’, the business pays over a flat rate percentage of the total (VAT inclusive) amount received from the customer. If this is, say, 10%, (the flat rate for transport) then the business gets to keep the rest of the VAT they have collected for themselves. This is theoretically to compensate them for input tax that they have suffered on buying in goods or services in the course of running their business, but often, small ‘service’ businesses will not have suffered much actual input tax.

However, in April 2017, new rules were introduced whereby a self-employed business which has very little input tax (because it does not have many expenses) must apply a rate of 16.5% under the FRS and not the rate for its particular business sector. This is known as the limited cost business rules. There is more about who is classed as a limited cost business on GOV.UK.

It is usual to get a 1% discount on the appropriate flat rate in the first year of being a VAT-registered business.

Disadvantages of voluntary registration

It may be the case that the ‘benefits’ of being VAT-registered/in the FRS are not as large as perceived. Also, they can be easily eroded by penalties for getting things wrong or for ongoing accountancy or Making Tax Digital for VAT software fees.

If you register for VAT, even voluntarily, you are obliged to keep very good records of your income and expenses, complete regular VAT returns (unless you use something like the annual accounting scheme), and make regular payments of VAT to HMRC.

All VAT-registered businesses must also comply with the Making Tax Digital rules, which requires VAT records to be kept digitally and VAT returns to be filed using commercial software. The only exception is if you are exempt.

If you decide you no longer want to be voluntarily registered for VAT or you change roles and are no longer self-employed then it is your responsibility to de-register so you are no longer expected to complete and file VAT returns.

There are very strict penalties for non-compliance with the VAT return requirements and deadlines and these rules changed from 1 January 2023. Being VAT-registered is certainly not something to be taken on lightly or entered into for the short term or with a casual attitude.