Tax relief for employment expenses

If you have paid expenses related to your employment, you may be able to claim tax relief. We explain more below, including the eligibility and evidence requirements. We also provide an example, showing you how to complete form P87, which you can use to claim tax relief on employment expenses.

Content on this page:

Eligibility

First things first, you should make sure that your expenses qualify for tax relief. You can find out more about expenses that you can claim for on our pages:

Note that for employment expenses to qualify for tax relief, you must have incurred them wholly, exclusively and necessarily in the performance of the duties of the employment.

You should keep records and evidence of any such expenditure.

If your employer pays you back for your employment expenses in full (in other words, they reimburse you), you cannot claim tax relief.

Even if you meet the rules, you need to make sure you have paid enough tax to get tax relief. In 2023/24 and 2024/25, you will pay tax on your earnings over £12,570 (your personal allowance).

Tax relief due

If you make a valid claim for tax relief, you will not receive the full amount of the expense back from HMRC – you will just receive tax relief on the amount at the rate of tax that you pay. For example, if you want to claim the standard allowance of £60 for washing your uniform at home and you pay tax at a rate of 20% in that tax year, you will receive tax relief of £12 (20% of £60).

How to claim

To get tax relief, you have to make a claim to HMRC, but it is not difficult to do so. If you do not usually have to complete a self assessment tax return, and your expenses for the tax year are less than £2,500, you can make a claim on form P87. If you are only making a claim in respect of flat rate expenses, you can also make a claim using HMRC’s online system.

See below under the headings Completing form P87 and Claiming tax relief on flat rate expenses online.

In most cases, you have to provide supporting evidence to HMRC when you claim tax relief on employment expenses. See below under the heading Evidence requirements.

There are plenty of organisations which offer to make the claim for you, but they will take a fee from any repayment you get. If you are thinking of paying a tax refund company to help you make the claim, we strongly recommend you read our guidance.

Where the amount of employment expenses exceeds £2,500, then the tax relief must be claimed by submitting a self assessment tax return.

Time limits

You have four years from the end of the tax year to make a claim; so, for 2024/25, HMRC must receive your claim by 5 April 2029. As we are in 2024/25, you can make a claim going back to the 2020/21 tax year.

From 14 October 2024, you must submit form P87 to HMRC by post. You should try to save a copy of the submitted form. Make sure you send it in good time to reach HMRC by 5 April. You might wish to ask the Post Office for proof of postage and keep this in case HMRC say they haven’t received your form.

Method of repayment

If the claim is for the current tax year, HMRC will usually make an adjustment to your tax code. If the claim is for a previous tax year, HMRC may make a repayment by cheque – they will either send the cheque to you or you can ask them to send it to someone else (your nominee). Alternatively, you can ask for the repayment to be sent direct to your bank or building society.

HMRC may also adjust your tax code for future tax years – this means the relief will be given automatically in your pay packets so you will not need to claim again (although you should make sure you check your PAYE coding notice carefully to ensure that the relief has been ‘coded in’ properly).

Be aware that HMRC used to process claims for tax relief on employment expenses on a ‘pay now, check later’ basis. This means that they would usually pay out a refund when they received a claim, even if you were not entitled to it. However, HMRC have the right to check the accuracy of the claim and the amount of the refund at a later stage – so they may ask for the money back if you have a historic claim that turns out to be incorrect.

Going forward, HMRC will check claims for employment expenses more carefully before making a payment – including looking at the evidence provided with the claim. They still might undertake further checks after a repayment is issued. It cannot be assumed that HMRC processing the claim means it is accepted as correct.

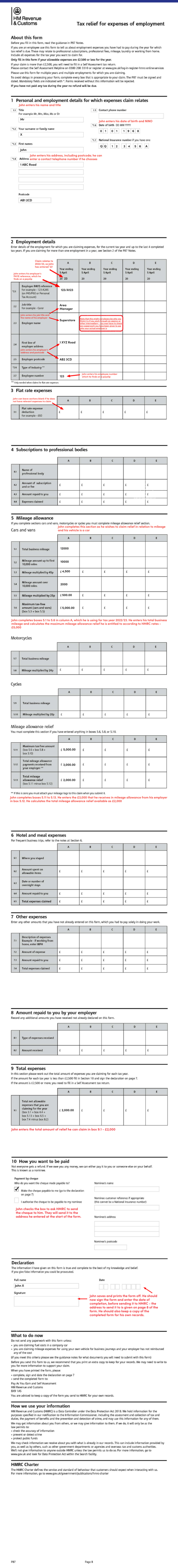

Completing form P87

From 14 October 2024, unless your claim relates only to flat rate expenses, you can only make a claim for tax relief on employment expenses by post. You can either complete form P87 onscreen, print it and post it to HMRC, or print it out and then complete it by hand, before posting to HMRC. Form P87 is available on GOV.UK. If you cannot print form P87, then you will have to ring HMRC’s helpline and request that one is sent out to you.

Make sure you have all information to hand before you start, including:

- The tax year your claim refers to.

- Your personal details including address, date of birth, and National Insurance number.

- Your employer’s details including name, type of business, address and employer PAYE reference number (you will find this on your payslip or P60). If you changed jobs during the year, you might need details for all relevant employments. If you do not have an ‘employee number’ you should insert ‘unknown’ otherwise you will not be able to progress.

- Details of the expenses you wish to claim, for example the number of business miles you have travelled.

- Repayment instructions – that is, the address you want a cheque to be sent to (you can also have it paid to a nominee).

In most cases, you have to provide supporting evidence to HMRC when you claim tax relief on employment expenses. See below under the heading Evidence requirements.

Remember to sign the form before you send it to HMRC. You should retain a copy of the completed form for your own records.

You should send your completed form, together with your supporting evidence to:

We use the annotated form plus example below to illustrate how you should complete the postal form P87. Please do not use the details provided in the example when completing your own form.

There is a HMRC guidance document to accompany the P87 form, which you can access on GOV.UK.

Before making a claim, double check you have not already received tax relief for your expenses. For example, might you have made a claim already but forgotten about it? Is it possible you already got tax relief for your employment expenses through your tax code? Also check that you earned enough to pay tax in the tax year. If you do not earn enough, you cannot claim tax relief – see the example on our page Minimum wage, tax and tax credits help for care workers.

Evidence requirements

From 14 October 2024, HMRC require supporting evidence in most cases. HMRC will check the evidence you provide with your claim. If they are satisfied that you are eligible for tax relief, they will process your claim.

We set out the evidence you need to send to HMRC below:

- General

-

For all claims, you must include details on the P87 form of the employment you are claiming expenses for and the PAYE reference number of your employer. You should be able to find this on your P45 or P60, in your personal tax account or on the HMRC App. See below under the heading PAYE reference number.

For all expenses, other than flat rate expenses, you must tell HMRC if you employer reimbursed any of the cost. If they did, you must provide evidence that shows how much your employer reimbursed.

- Flat rate expenses

-

You must include details of the type of industry you are employed in.

If you are claiming the flat rate expense only, you do not need to provide any supporting evidence. If you want to claim more than the flat rate, or the exact amount you paid, you should complete the Other expenses section of form P87 and provide supporting evidence.

- Professional fees and subscriptions

-

You must include copes of receipts, or other evidence that shows how much you paid.

- Mileage allowance

-

This relates to claims for tax relief for using your own vehicle. You must send HMRC a copy of your mileage log. This should include details such as, the reason for each journey, and the postcodes for the start and end points.

If you wish to claim tax relief for travel in a company vehicle, you should use the Other expenses section of form P87.

- Hotel and meal expenses

-

You should provide copies of receipts that include the date of your stay or meal, and the name of the hotel or restaurant.

- Working from home

-

You need to send HMRC evidence that you have to work from home. This might be a copy of your employment contract.

You do not need to provide any evidence if you are claiming tax relief for the tax years ended 5 April 2021 and 5 April 2022. There is an exception for those two tax years, because of the coronavirus pandemic.

- Other expenses

-

You should provide copies of receipts or other evidence that shows the item and what you paid.

PAYE reference number

As noted above, you must include your employer’s PAYE reference number to make the claim. A PAYE reference number (or employer reference number) consists of a unique set of letters and numbers used by HMRC to identify your employer and their Pay As You Earn (PAYE) scheme.

The reference is in two parts. The first part is made up of three digits and tells HMRC which tax office looks after that particular employer. The second part can be a combination of letters and/or numbers which will identify the employer that the reference belongs to. A typical reference may look something like this 123/AA6543.

As the PAYE reference number identifies the employer, not the employee, if you work for more than one employer, you will have more than one PAYE reference number.

You may be able to find the number on payroll correspondence from your employer. Although it is not a legal requirement for employers to include it on a payslip, some employers do include it.

It can also be found on a P60 or P45.

You may be able to find your employer PAYE reference number in your personal tax account (PTA). From the home page of your PTA, select the tile called Pay As You Earn (PAYE). Your employer PAYE reference number is available in a number of different places, but probably the easiest place is PAYE Income Tax history.

Claiming tax relief on flat rate expenses online

Some employees can claim tax relief on a fixed amount each tax year. This amount is meant to cover what you spend on tools and clothing (uniform) that you need to do your job.

HMRC set the amounts that you can claim, depending on the industry you work in and the job you do. If you want to claim tax relief on the fixed amount only, you do not have to provide any evidence to support your claim.

You can make your claim for tax relief using form P87 or online. There is guidance on the different amounts you can claim and a link to the online claim service on GOV.UK.

Annotated example of form P87

Other useful guidance

HMRC used to operate a process now/check later system in respect of the amount of tax relief being claimed. However HMRC can check claims, often years after the claim was submitted, so it’s important to try and make sure your claim is as accurate as possible.

From 14 October 2024, HMRC require evidence to support form P87 claims. This is to try to ensure HMRC only pay tax refunds to you if you are eligible for tax relief.

Deductible employment expenses – not all expenses quality for tax relief. In fact, for most employment expenses, you must have incurred them wholly, exclusively and necessarily in the performance of the duties of the employment, which is a hard test to meet.

Tax relief if you use your own car – this comes in the form of a flat rate amount for the number of business miles you have travelled. However the miles have to be business miles, not ordinary commuting and sometimes it is not easy to tell which is which.

Guidance on using tax refund companies - there are plenty of organisations which offer to make the claim for you, but they will take a fee from any repayment you get. Some may also act in bad faith and cause you problems in the future.

In particular, if you are thinking of paying a tax refund company to help you make a claim for work expenses, we strongly recommend you read HMRC’s warning about incorrect or inflated expenses, in their claiming expenses – don’t get caught out campaign on GOV.UK.