Registering for self assessment

Registering for self assessment refers to the process by which HMRC issue you with a unique taxpayer reference (UTR) (if you don’t already have one) and send you a formal notice to file a tax return for a year. If you need to send a self assessment tax return for the first time, you will need to register with HMRC for self assessment.

Content on this page:

How to register

There are different ways to register depending on your circumstances. If you are self-employed, see our separate guidance.

If you are not self-employed, you should complete form SA1 to register for self assessment. This must either be completed and submitted online, or be completed on screen and then printed off and posted to HMRC. The form is on GOV.UK. If you do not have access to a computer to do this, you should contact HMRC.

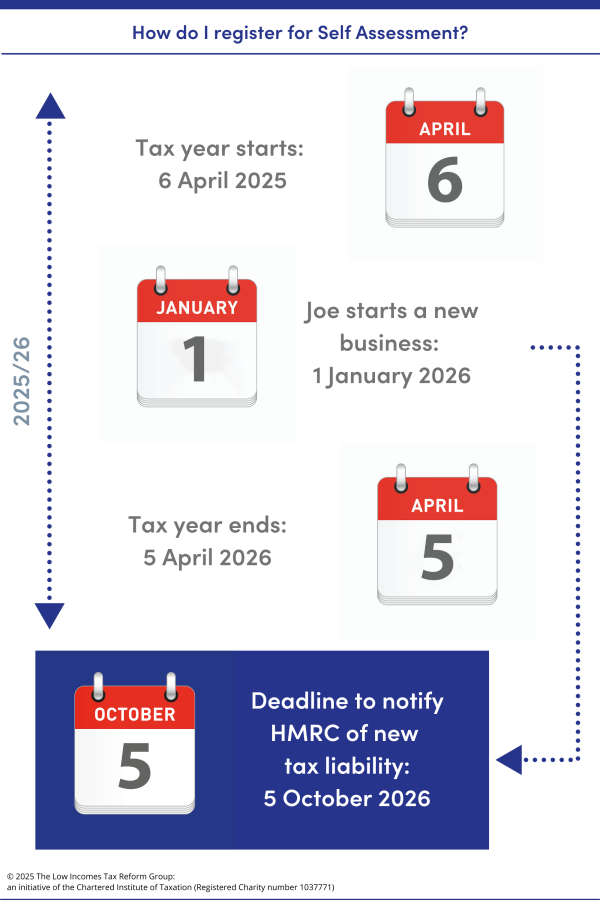

Deadlines

If you need to notify HMRC that you owe tax for a year (see Who has to complete a tax return), you must do so by 5 October following the end of the tax year. For example, if you received rental income in the 2023/24 tax year, you should register with HMRC by 5 October 2024.

The above deadline does not apply where HMRC have already asked you to file a tax return for the year. For example, if you already file tax returns for another reason but you start to receive a new source of income, then you would usually just report that new source of income on the relevant return (though you may need to register separately for class 2 National Insurance if you commence self-employment).

If you miss the notification deadline, then you may be charged a penalty for failure to notify.

However, if you notify HMRC after 5 October, then provided you have paid your income tax liability in full by the usual 31 January payment deadline, HMRC should reduce any late notification penalty to zero. Note in these circumstances it is a good idea to try and complete your return by 31 January too (though, strictly, you may have longer), so that you can quantify the amount of tax due and demonstrate this to HMRC prior to the payment deadline.

If you have reported a property disposal within 60 days, you may still need to register separately for self assessment.

If you already have a UTR

If you already have a unique taxpayer reference (UTR) – perhaps because you filed tax returns some years ago – then you should still notify HMRC by the 5 October deadline if you need to file a tax return for the previous year.

HMRC will then issue a formal notice to file a tax return for the previous year.