Payroll giving

If you pay tax through pay as you earn (PAYE), payroll giving is a simple way of making regular gifts to charity. You ask your employer or pension payer to make the donation from your pay or pension. Payroll giving is sometimes called ‘give as you earn’ or workplace giving.

Content on this page:

Tax relief

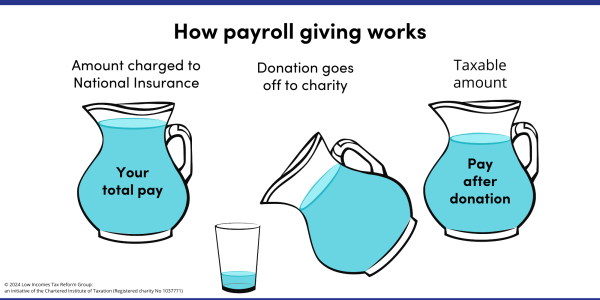

Your employer or pension payer takes off the payments before working out and deducting your tax, so you get tax relief on your donation immediately. The relief is worked out at your highest rate of tax.

For example, if you pay tax at the basic rate of 20%, and give £10 a month, you save £2 a month tax (20% of £10). The actual cost of the donation to you is only £8. You will however, pay National Insurance contributions (NIC) as normal on the £10.

If you do not earn enough money to pay tax, you will not get tax relief on your donation.

When you can use it

You can use payroll giving as long as both of the following apply:

- You are an employee or you get a company or personal pension and your employer or pension payer deducts tax through the PAYE system.

- Your employer or pension payer operates a payroll giving scheme. You will have to check this with them.

How it works

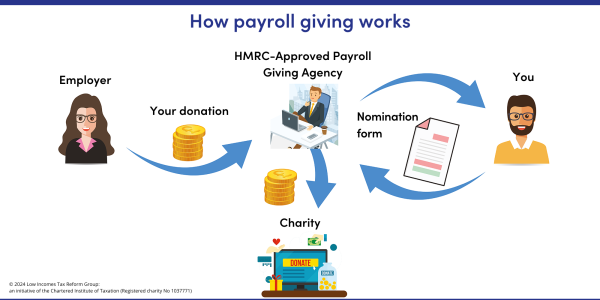

The payroll giving agency running the scheme provides you with a charity nomination form, which you complete and return directly to the agency to tell them where to send your donations.

Your employer or pension payer passes your donation to the payroll giving agency, who then passes it to your nominated charity (or charities). You do not have to tell your employer or pension payer which charities you support.

Once a gift has been deducted from your pay or pension, no refund is possible. Some charity agencies may charge a small fee, which is deducted from your donation, to cover administrative costs.

Gift aid

Payroll giving does not affect any other donations you might want to make to charity. You can, for example, make other donations using gift aid if you wish.

National minimum wage

Donations made under payroll giving do not reduce your pay for national minimum wage purposes. This means you may make donations under payroll giving even if you are earning at the national minimum wage (or national living wage, if appropriate).

Self assessment

You do not need to put details of gifts made through payroll giving on your self assessment tax return if you complete one, or tell HMRC about the donations in any other way at all.

This is because you will already have received the correct amount of tax relief on your donation and there is nothing else to do. The figure for taxable pay on your P60 or P45 should already be reduced for the amount of donations made under payroll giving.

You might, however, want to keep records for yourself.

More information

You can read more about payroll giving on GOV.UK.