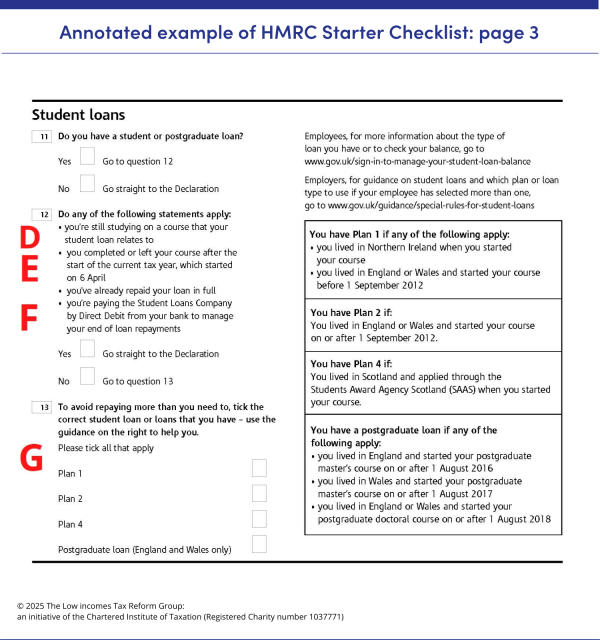

Annotated starter checklist: student loans

We provide an annotated copy of page 3 of the starter checklist for new employees to help you understand the questions on student loans.

Student loan questions on the starter checklist

Below is a copy of a starter checklist and guidance on specific questions about student loans.

D and E

You only start repaying your student loan from the April after you completed the course that your loan relates to. So, if you graduated in Summer 2023 you will start repaying your loan from 6 April 2024 (if you earn above the repayment threshold).

If you finished your course after 6 April 2024 then you will not be required to make repayments on your loan until the following tax year (2025/26).

Please note: this will only relate to your most recent student loan and if you have another loan, from an earlier course that ended before 6 April 2024, then you will begin repayments for the other loan as soon as you begin work and earn above the relevant repayment threshold.

F

If you are coming to the end of paying your only remaining student loan and have agreed to pay the Student Loans Company (SLC) directly through monthly direct debits then answer ‘Yes’ here. There is information explaining how student loans are calculated and repaid through the Pay As You Earn system on our page: Employees: student loan repayments.

If you are making only additional voluntary payments to the SLC, then you should answer ‘No’ here. Your student loan repayments will be calculated in addition to any voluntary payments (this is different to opting to pay the SLC directly when coming to the end of repaying your loan).

G

It is very important that you state the correct loan type(s), otherwise incorrect loan repayments will be deducted as the different plans have different repayment thresholds.

If you are unsure what type of student loan you have then you should contact the SLC.