Employees: student loan repayments

Employee student loan repayments come off your wages before you get them, so check your payslips!

This page explains how student loan repayments are deducted through the Pay As You Earn (PAYE) system if you have a Plan 1, Plan 2 or Plan 4 income-contingent student loan. If you have a postgraduate loan, see our separate page.

If you have gone to work abroad and are not in the UK tax system, you will need to make a payment arrangement direct with the Student Loans Company (SLC).

Content on this page:

Plan 1, Plan 2 or Plan 4 student loans: PAYE repayments

Your employer is usually tasked with taking student loan repayments off your wages through PAYE. Your payslips will usually have an entry described as ‘student loan’ but will not show how the repayment has been calculated. Your employer will pay the repayments to HM Revenue & Customs (HMRC), who then pay them to the SLC. The SLC then shows your new loan balance on your borrower account with them, however this may take some time to be updated in order to show an accurate position.

If you are nearing repayment of your loan in full, you can sometimes ‘opt out’ of PAYE and arrange a direct debit to the SLC instead. This is explained under the heading below: Opting out of Plan 1, Plan 2 and Plan 4 PAYE repayments.

If you are employed at the beginning of the tax year in which you are due to start making repayments, the SLC should notify HMRC. HMRC in turn issue a ‘start notice’ to your employer who will then calculate student loan deductions along with your tax and National Insurance contributions and pay them to HMRC through the PAYE system.

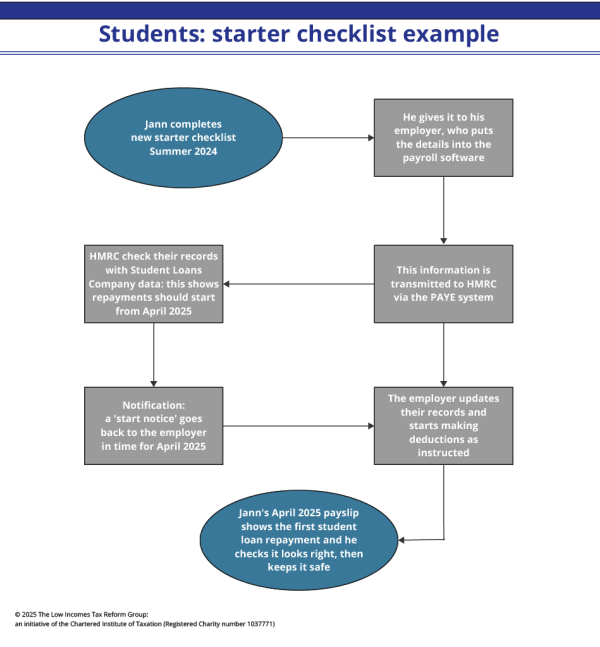

When you start a job, as part of their new starter checklist (previously known as form P46), your employer should ask you whether you have a student loan on which you are due to start making repayments. Your employer will also ask what type of loan you have. It is important to provide the correct information as this will affect what loan repayments you make. We provide an annotated example of a starter checklist to help explain how you should answer the questions so that the correct loan repayments are made.

If you think you are having deductions taken off using an incorrect student loan plan, you should firstly check with your employer to see what plan type they are using for your student loan deductions. If you think it is wrong, you should confirm your plan type with the SLC. You should notify your employer of the correct student plan. HMRC also check that employers are making student loan repayments using the correct plan types and will prompt them to make changes if an incorrect plan type is being used.

The exact process of making loan repayments under the PAYE system depends on timing – below we look at a couple of examples which would be the same if you have a Plan 1, Plan 2 or Plan 4 student loan.

The flowchart below illustrates how this works:

Employed earnings for Plan 1, Plan 2 and Plan 4 loans

Your earnings for student loan purposes are calculated in the same way as they are for National Insurance contributions (NIC). This is not always the same figure as the earnings on which you pay income tax. For example, NIC is not due on loans your employer makes to you and tips may not be chargeable to NIC. You can find guidance on tax and NIC on benefits in kind, listed alphabetically, on GOV.UK.

Any income from employment which you earn before the date you are due to start making repayments should not be taken into account in calculating the amount you have to pay.

Pension contributions

Normally, pension contributions that you make through your employer’s payroll will be deducted from your pay for income tax purposes, but they will not reduce your pay for National Insurance purposes and hence will be included when calculating student loan repayments.

Pension income

Taxable income from pensions that you receive is not counted as earned income, but as unearned income, so it may affect the amount you are required to pay back on your student loan if you complete a self assessment tax return.

Calculating repayments for Plan 1, Plan 2 and Plan 4 loans

Plan 1, Plan 2 and Plan 4 repayments are due at a rate of 9% on earnings over the respective student loan plan repayment threshold.

Each pay day is looked at separately. Your repayments may vary according to how much you are paid in any particular week or month. If your income falls below the starting limit for that week or month, your employer should not make a deduction.

In summary, your employer calculates and deducts repayments each pay day. You can only get a refund based on your annual earnings if your income for the tax year is less than the repayment threshold for the loan plan you are repaying. We explain more about refunds further down this page.

The examples below illustrate how repayments are calculated depending on if you have a Plan 1, Plan 2 or Plan 4 loan. We have further guidance if you are repaying more than one loan.

- Plan 1 repayment calculation

-

Jack is paid monthly. His employer has received the HMRC ‘start notice’ to begin deducting Plan 1 student loan repayments from 6 April 2024 if his income goes over the threshold – £24,990 a year, which works out to £2,082.50 a month.

Jack's basic salary is £24,000 a year, or £2,000 a month, but the summer months are busy and he has to work overtime. In July, he earns an extra £450 and notices that a deduction has been made from his pay for student loan repayments. He asks how this was calculated and why he has to pay it.

His employer explains that his total pay in July was £2,450, which is £367.50 more than the £2,082.50 a month threshold for loan repayments. This £367.50 is multiplied by 9% to give a student loan deduction of £33.07. - Plan 2 repayment calculation

-

Patrick is paid monthly. His employer has received the HMRC 'start notice' to begin deducting Plan 2 student loan repayments from 6 April 2024 if his income goes over the threshold – £27,295 a year, which works out to £2,275 a month.

Patrick’s basic salary is £21,000 a year, or £1,750 a month, but the summer months are busy and he has to work overtime. In July he earns an extra £800 and notices that a deduction has been made from his pay for student loan repayments. He asks how this was calculated and why he has to pay it.

His employer explains that his total pay in July was £2,550, which is £275 more than the £2,275 a month threshold for loan repayments. This £275 is multiplied by 9% to give a student loan deduction of £24.75.

- Plan 4 repayment calculation

-

Lakbir completed his undergraduate course in 2015 and was repaying his student loan through Plan 1 repayments. He currently earns £33,000 per year (£2,750 a month) and was informed that his student loan repayments moved from Plan 1 to Plan 4 from April 2021.

Lakbir will have student loan repayments automatically deducted through his pay if he earns above the Plan 4 repayment threshold: £31,395 a year for the 2024/25 tax year, which is £2,616 a month.

At the end of April 2024, Lakbir checks his payslip and sees that there is a ‘student loan’ deduction of £12.06; this is calculated as Lakbir’s gross pay (before deductions for tax and NIC) of £2,750 minus the monthly repayment threshold of £2,616 x the repayment rate (9%):

- £2,750 – £2,616 = £134

- £134 x by 9% = £12.06

Later, when Lakbir checks his borrower balance with the SLC, he can see that this deduction has been taken off his outstanding balance.

So, as you can see from the examples above, student loan deductions are calculated on a ‘per pay period’ basis. This is how National Insurance contributions (NIC) are worked out. In most cases, this is week by week or month by month according to how frequently you are paid.

This means your employer cannot take account of any ‘spare allowance’ up to your loan plan’s annual repayment threshold and cannot refund it in a later month if your wages fall back below the starting point.

Refunds for Plan 1, Plan 2 and Plan 4 loans

If you have fluctuating income and your pay varies per pay period, this may result in some pay periods where you earn above the repayment threshold and so student loan repayments are deducted by your employer.

Overall, if you earn less than the annual repayment threshold for your loan plan but have had student loan repayments deducted through the PAYE system, you can only get a refund based on your annual earnings if either:

- you have to complete a self assessment tax return, or

- you apply directly to the SLC for a refund.

You cannot get a refund of deductions via the PAYE system.

When making a direct application to the SLC, you will have to show them that your total earnings in the tax year did not exceed the annual repayment threshold for your loan plan. If you do not ask the SLC for a refund, the amount will go towards paying off your loan.

Repaying Plan 1, Plan 2 or Plan 4 loans: more than one job

If you have more than one employment and work for different, unconnected employers, your student loan deductions are calculated separately on each one. Again, this follows a similar principle to National Insurance contributions (NIC), which are usually calculated on a job-by-job basis.

- Plan 1 repayments if more than one job

-

Katrina has an income-contingent Plan 1 student loan. She works part-time at Company A, earning £15,500 a year. As she is not earning above the threshold (£24,990 for the 2024/25 tax year), she does not have to make loan repayments.

In April 2024, she gets another part-time job for Company B, earning £10,000 a year. Company B is not in any way related to Company A.

Even though her total earnings are now £25,500 a year, neither employer has to deduct student loan repayments as each is within the £24,990 threshold.

However, if Katrina were required by HMRC to fill in a tax return, both employments would be combined in the overall student loan repayment calculation and she would then have to make repayments based upon her total earnings of £25,500. There is more on self assessment on a later page. - Plan 2 repayments if more than one job

-

In April 2024, she gets another part-time job for Company B, earning £6,000 a year. Company B is not in any way related to Company A.

Even though her total earnings are now £27,500 a year, neither employer has to deduct student loan repayments as each is within the £27,295 threshold.

However, if Emily were required by HM Revenue & Customs (HMRC) to fill in a tax return, both employments would be combined in the overall student loan repayment calculation and she would then have to make repayments based upon her total earnings of £27,500. There is more on self assessment on a later page.

- Plan 4 repayments if more than one job

-

Jacob has a Plan 4 income-contingent student loan. When he graduated, he took part-time work with Company A, earning £29,000 a year. As he is not earning above the threshold (£31,395 for the 2024/25 tax year), he does not have to make loan repayments.

In April 2024, he gets another part-time job for Company B, earning £6,000 a year. Company B is not in any way related to Company A.

Even though his total earnings are now £35,000 a year, neither employer has to deduct student loan repayments as each is within the £31,395 threshold.

However, if Jacob were required by HM Revenue & Customs (HMRC) to fill in a tax return, both employments would be combined in the overall student loan repayment calculation and he would then have to make repayments based upon his total earnings of £35,000. There is more on self assessment on a later page.

Opting out of Plan 1, Plan 2 and Plan 4 PAYE repayments

You cannot normally choose how you repay your Plan 1, Plan 2 or Plan 4 income-contingent student loans. If you are an employee, then Pay As You Earn (PAYE) deductions must be made in most cases.

But if you are getting close to full repayment, the SLC recommends that you switch to direct debit repayments to avoid paying too much through PAYE and then having to get a refund from the SLC.

This is because PAYE deductions are calculated at 9% of pay above the repayment threshold for your specific loan plan rather than on what you owe. Even though HMRC and the SLC frequently share data, which should mean that your SLC account is updated regularly, it may not be completely accurate. Therefore, it is recommended to pay the SLC directly during the final two years of loan repayments.

The direct debit facility allows you to opt out of PAYE deductions up to two years prior to anticipated full repayment.

The SLC should monitor borrowers' accounts with a view to identifying if you are getting close to full repayment and contact you to offer the switch to direct debit. Most borrowers can switch to making direct debit repayments using the SLC’s online repayment system. But if your income fluctuates or if there is a delay in HMRC passing repayment information to the SLC, it could be difficult for the SLC to work out when you might be nearing full repayment.

In these situations, you can contact the SLC and, on production of evidence such as your form P60 and payslips, you may be able to agree with them a move to direct debit. You should ensure that the SLC have up-to-date contact details for you.

If you do not keep up your direct debit repayments, you will go back into the PAYE repayment system.

Watch out if you change jobs

Where you have switched to direct debit repayments and then move jobs, you must take care when providing new starter information so that you do not pay twice – by both direct debit and through PAYE.

This means that if you have agreed with the SLC to pay by direct debit, you must notify your employer that you are making direct monthly repayments through an agreement with the SLC.

If you have already overpaid, you should contact the SLC as soon as possible and ensure they have your correct bank details. As explained in this GOV.UK news article, be wary of any phishing emails or messages from fraudsters pretending to be the SLC.