Minimum wage, tax and benefits help for care workers

Care workers can face some challenges when it comes to understanding their minimum wage, tax and benefit positions due to the nature of care work and the travel patterns involved. Here, we give you an overview of some of the main issues and tell you where to get more help.

Content on this page:

National minimum wage

The national minimum wage/national living wage (NMW/NLW) is the minimum pay per hour most workers are entitled to by law. You can find more information on our page National minimum wage.

In summary, if you are paid on an hourly basis, the calculation to work out if you have been paid the minimum wage involves taking your ‘minimum wage pay’ and dividing it by the number of hours worked in that pay period. The result should be equal to or above the minimum hourly rate for your age.

Minimum wage complexities facing care workers

We know some care workers only get paid with reference to their ‘contact time’ (time spent with clients) and not their travel time.

While this can cause complexities, it is not unlawful for care workers to be paid only by reference to their ‘contact time’, provided their pay averages out at or above the minimum wage, once any time spent travelling between clients (and associated out-of-pocket expenses – see below) are also factored in. However care workers who receive lower pay rates per hour are at risk of being underpaid when travel time and costs are factored into the minimum wage pay calculation. It is therefore vital that you regularly check your wages against your contact/travel time and costs.

- Working out number of hours worked

-

It is fairly straightforward to work out if you have been paid the minimum wage if you work a set number of hours at one fixed location. But if your working hours are fragmented and you spend a lot of time travelling around, as is often the case for care workers, then it is more complicated.

For care workers, you still take your minimum wage pay and divide it by the numbers of hours worked in that period. But the number of hours worked in a period will generally include the time you spend working in your clients’ homes (contact time) as well as the time spent travelling between your different clients during the day.

The number of hours worked in a period does not include travel time between home and a place of work (including your clients’ homes) or any resting time. This is despite the fact that client demand may mean that you have a fragmented rota where there is really nothing to do except go home. Interestingly, if you were to travel to the office to sit out a break rather than going home then the amount of time travelling to and from the office would count (although the time spent ‘resting’ there would not).

There are some useful examples looking at care workers and travel time/resting time on GOV.UK.

Example – calculating working time for minimum wage purposes

Jo, 37, is a home care worker. A typical day for Jo looks something like this:

Time Activity 7.10am Leave house 7.20am to 8.05am First appointment, followed by 10-minute drive to: 8.15am to 8.45am second appointment, followed by 10-minute drive to: 8.55am to 9.40am third appointment, followed by 5-minute drive home 9.45am to 12.10pm gap spent at home 12.10pm leave house 12.15pm to 12.45pm fourth appointment, followed by 5-minute drive to: 12.50pm to 13.35pm fifth appointment, followed by 10-minute drive home 1.45pm to 3.50pm gap spent at home 3.50pm leave house 3.55pm to 4.55pm sixth appointment, followed by 5-minute drive to: 5pm to 5.45pm seventh appointment, followed by 15-minute drive to: 6pm to 6.15pm eighth appointment, followed by 10-minute drive home 6.25pm arrive home

Jo’s total working hours for the day, for minimum wage purposes, are six hours (5 hours and 15 minutes client ‘contact’ time and 45 minutes travel time). Neither her home to work travel, nor time spent at home counts for minimum wage purposes. - Working out minimum wage pay

-

Your ‘minimum wage pay’ is the amount of pay you receive, before things like tax, National Insurance and pension contributions have been taken off, but after certain other deductions have been made. These include deductions for any pay premiums you have received (for example, for weekend work) or for costs you have incurred in connection with your work that are not reimbursed by your employer.

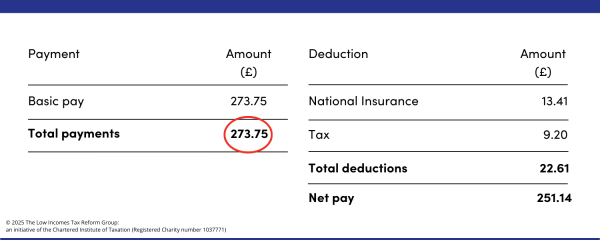

If you receive a payslip, the starting point for working out your minimum wage pay will generally be the ‘gross’ pay figure – it may not be actually called this, but it is basically the figure circled in red on the graphic below. The graphic shows that the figure in this instance is referred to as ‘total payments’.

LITRG creation by Canva.com

LITRG creation by Canva.comAs stated above, from this figure you can deduct certain costs that you have incurred that are connected with work and that are not reimbursed by your employer. This will have the effect of reducing the amount of pay you are taken to have received from your employer.

For care workers, a typical example of such costs is travelling between clients – but not the costs of travelling between home and work. Confusingly, home to work travel is usually recognised as being an inherent part of a care worker’s duties for tax purposes. This means that the tax system should allow you to make a tax deduction for all your travel costs – even the home to work ones (see the heading Treatment of unreimbursed travel costs for tax purposes below).

For minimum wage purposes, we understand that where care workers are using their own cars to travel between clients, ‘costs’ are probably limited to actual fuel expenses rather than including any contribution towards wear and tear or other vehicle related expenses.

If you use your car for both work and private purposes, it can be hard to work out the specific cost of the petrol used in travelling between clients. However, if you keep a mileage log (see example below under heading Appointments that are cut short or overrun) as part of your records, the appropriate percentage of work use can be identified and so, therefore, can your costs.

Example – calculating minimum wage pay deductions

Keith is a 40-year-old care worker, paid monthly. His working hours for minimum wage purposes in May were 100 and he received gross pay of £1,150. He travelled 200 miles in his own car during May. 125 of these miles were for travelling between his clients. If his total petrol costs during May were £40 then he will be able to work out that his specific petrol costs of travelling between clients were £25, by doing the following calculation (£40 x 125/200). As this £25 was not reimbursed to Keith by his employer, Keith can deduct £25 from £1,150 to work out his pay for minimum wage purposes, which is therefore £1,125.

To work out if Keith has been paid the minimum wage, we need to take his minimum wage pay and divide it by the number of hours worked in that period. £1,125 divided by 100 is £11.25, so Keith has been underpaid the minimum wage (his minimum hourly rate is £11.44, which means he should be paid at least £1,169 for 100 hours and £25 costs). For completeness, if Keith’s employer had reimbursed him his £25 costs, his minimum wage pay would be £1,150 (resulting in an hourly rate of £11.50) and there would be no breach.

All of this means that, in practice, employers should consider reimbursing fuel costs in full on top of a national minimum wage hourly base rate for workers who are on or around the national minimum wage. This will ensure the employer does not fall foul of the NMW rules. Alternatively, employers may need to increase the worker’s hourly base rate so that there is enough ‘head room’ in it, to absorb the fuel costs without taking their average pay below the NMW.

- Differing rates for contact time and travel time

-

It is quite common for care workers to receive different pay rates for different ‘types’ of work – these all count when working out pay for minimum wage purposes.

Example – minimum wage calculation with differing pay rates

Sasha, aged 32, is paid at a rate of £11.50 per hour for ‘contact’ time and £5 per hour for travel time. Her total pay for the day is £64.12 (5 hours, 15 minutes at £11.50 per hour (£60.37) and 45 minutes at £5 per hour (£3.75)). Assuming that this is the only day’s work in her pay period, we need to take her minimum wage pay of £64.12 and divide it by six hours (her total working hours), which is £10.68. As this is less than £11.44, Sasha has been underpaid the minimum wage.

- Appointments that are cut short or overrun

-

Sometimes employers may schedule appointments that are very short or without leaving adequate time for travel in between them. Often you may feel forced to cut time off of calls in order to arrive at your next call on time or finish calls in your own time, yet will only get paid based on time you were due to work.

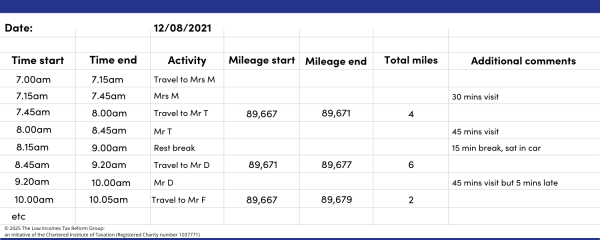

For minimum wage purposes, what is important is not what is written down on your rota, but what actually happens in the course of the day. It will therefore be vital that you can correctly identify your actual working hours and costs. Keeping clear, detailed, well-maintained records of your contact time, travel time and costs incurred will help you do this – this can be on an excel spreadsheet perhaps or even just be written down by hand in a journal that you keep in your car – we provide an example below of how you could set things out.

LITRG creation by Canva.com

LITRG creation by Canva.comThis will not only help you in the event of a dispute as to whether you have been paid the minimum wage, but may be useful more widely – for example when thinking about making a tax claim for your mileage (see the heading Treatment of unreimbursed travel costs for tax purposes below).

Example – minimum wage calculation – importance of recording working hours

John, 60, has a 6 hour day scheduled (including his travel between appointments). He leaves his second appointment (which should have been half an hour) five minutes late, so that it was actually 35 minutes long), gets stuck in traffic for ten minutes between appointments and then spends an extra 15 minutes at his third appointment.

John’s total working time for minimum wage purposes is six hours, 30 minutes. The minimum amount paid to him should be the hourly rate of £11.44 for six hours, 30 minutes, i.e. £74.36. If he is paid in accordance with what is written down on the rota, i.e. six hours at £11.44 (£68.64) – then he has been underpaid by £5.72.

- More information

-

For more information, including on other areas of minimum wage law that may affect you – for example, on training, uniform deductions from pay, or receiving premium rates for certain shifts; and on what to do if you think that your employer is not paying you the full minimum wage to which you are entitled, see our page National minimum wage.

Note – if you are paid more than the minimum allowed by law, then whether your travel time and costs are paid/reimbursed is a matter for negotiation between you and your employer. You should check any contractual terms and conditions you sign up to, very carefully.

Treatment of unreimbursed travel costs for tax purposes

For tax purposes, many care workers will be able to deduct all their travel costs from their taxable income, including those related to home to work travel. This is because, like a ‘service engineer who moves about from place to place during the day, carrying out repairs to domestic appliances at client’s premises’ (wording taken from HMRC’s manual), their duties inherently involve travelling. Even if you do not have a travelling appointment, it is likely every place that you attend is a temporary workplace, which also means that relief should be due.

There is information on the rules for travel expenses on our page Employment expenses: travel.

Where the rules apply to a journey, and you incur rail, bus, and other transport charges, to the extent they are not fully reimbursed (or reimbursed at all) by your employer they can be claimed as a tax deduction.

If you use your own transport for such journeys (for example, your own car) there is the statutory system of tax-free approved mileage allowances for business journeys available. If your employer pays less than these amounts, you can claim tax relief for the unused balance of the approved amount.

The mileage rate covers the costs of running and maintaining the vehicle, such as fuel, oil, servicing, repairs, insurance, vehicle excise duty and MOT. The rate also covers depreciation of the vehicle. This is a bit more generous than what you are allowed to deduct to arrive at your pay for minimum wage purposes (only fuel).

Note that there is some HMRC guidance that suggests that where care workers are agency workers, they will only accept that the cost of travel between different jobs on the same day is allowable, and they will not accept a deduction for the cost of travel from home to the first job of the day or to home from the last job of the day. We are not clear what HMRC are basing this interpretation on. Indeed, there has been a case where HMRC’s stance on this has been called into question. This should, by no means, be relied upon and it is very important that care workers keep good, detailed mileage records.

Claiming tax relief

Even if you meet the rules on allowable travel, you need to have paid enough tax to get tax relief. In 2024/25, you will usually pay tax on your earnings over the personal allowance (£12,570). In other words, if your income is less than £12,570 you will not be able to get any tax relief on travelling expenses that are not reimbursed by your employer.

To get tax relief, you have to make a claim to HMRC, but it is quite straightforward. If you do not usually have to complete a tax return, a claim can be made on form P87.

Where the amount of employment expenses exceeds £2,500, then the tax refund claim must be made through the completion of a more formal self assessment tax return.

Tax credits and universal credit

Deducting unreimbursed travel costs

A person’s entitlement to working tax credit is based upon his/her level of taxable earnings – against which permitted tax deductions are taken. Permitted deductions can include travel expenses that you are entitled to tax relief for, but which are not reimbursed by your employer.

This means that where £50 of a care worker’s £275 weekly earnings are attributable to travelling expenses, they will have an annual income for tax credit purposes of £11,700 (£225 x 52), rather than £14,300 (£275 x 52), potentially meaning a higher tax credit award.

For tax credits, employment expenses are deducted from income if they are allowable for tax, even if full effect cannot be given to them for tax purposes because the worker does not earn enough to incur a tax liability.

A similar rule applies for universal credit.

However, you should be aware that both tax credits and universal credit can use earnings information received by HMRC from employers to set awards, which does not include unreimbursed expenses amounts. You will therefore need to provide HMRC (for tax credits) or the DWP (for universal credit) with revised earnings amounts.

You can find more information on how to do this for tax credits on our specialist site, RevenueBenefits.

For universal credit, we understand this can be done via your UC online account journal (for more information see GOV.UK).

Affect of unpaid travel time

Working tax credit (WTC) is payable to claimants who are in ‘qualifying remunerative work’ and who are on a low income. The number of hours required will depend on your circumstances as set out in the guidance on our website.

Qualifying remunerative work is work for which the claimant is, or expects to be, paid. There is an issue for care workers here: if your employer does not pay you directly for your travel time (even if your overall remuneration at least equals the minimum wage) then those travel hours do not count as paid work for tax credits. This means that your weekly remunerative hours may be insufficient to meet the minimum WTC requirement.

If you are in this situation, you could try talking to your employer about making changes to your terms and conditions.

For universal credit, you do not need to work a minimum number of hours to qualify but there may be a minimum amount that you are expected to earn. This will be agreed between you and your work coach, as part of your claimant commitment.

Fluctuating hours

If your weekly hours of paid work change this can affect entitlement to working tax credit, as there are rules about how many hours you have to work to qualify. However, the working hours rule in tax credits depends on the hours of work you normally do per week and so, often, fluctuations of a few hours week by week will not make a difference as long as you normally continue to work the minimum required for your circumstances. If things change significantly so that your normal weekly hours of paid work change, you will need to tell HMRC as this could affect your award.

You may be entitled to more money if your hours increase and you start to normally work at least 30 hours a week, or your WTC may reduce or stop if you reduce your hours below one of the thresholds. Note that while your income, as well as your hours, may fluctuate, the disregard system provides some cushioning for tax credits purposes, meaning that your income can rise or fall by £2,500 compared to the previous year before your tax credits are changed in the current tax year.

For universal credit you do not need to work a minimum number of hours to qualify but there may be a minimum amount that you are expected to earn. This will be agreed between you and your work coach, as part of your claimant commitment.