PPI tax refunds - new evidence requirement

Due to concerns over the nature and scale of R40 claims for PPI tax refunds being submitted by certain tax refund companies, HMRC will now require evidence before they progress a claim for a PPI tax refund. This is to ensure they are only processing claims that are correct and properly authorised by the taxpayer.

Content on this page:

Background

For a long time, we have been concerned about the behind-the-scenes relationships that seem to exist between some Payment Protection Insurance (PPI) claims management companies and certain tax refund companies. We summarised our concerns in a recent article called ‘Why is my tax refund being sent to a third party I’ve never heard of?'

On 26 October 2023, HMRC ‘paused’ processing of all claims for PPI tax refunds on the R40 form while they considered the best way to manage the risks, such as those identified by LITRG. Any forms that HMRC have ‘paused’ since this date will be returned to the taxpayer. They will need to be resubmitted with evidence of the original PPI payment.

The evidence required can be:

the final response letter from the financial institution that refunded the PPI payment to the taxpayer, or

a certificate from the financial institution that refunded the taxpayer to confirm the amount of tax deducted from the refund

Going forward HMRC will be writing to all taxpayers where an R40 form for a PPI tax refund is submitted, to inform them of this requirement where the evidence is not already attached.

We understand agents who have a 64-8 in place will receive a copy of the correspondence sent to taxpayers.

Why have I received a letter?

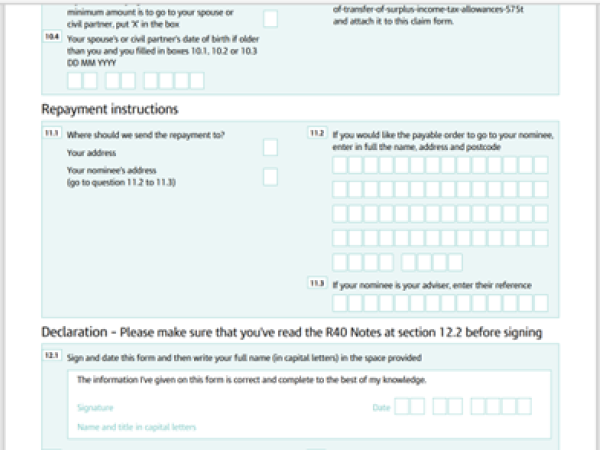

You have received a letter because HMRC have received an R40 form for you telling them that you would like to claim tax back on interest paid on a PPI claim. You may have submitted this yourself or a tax refund company may have submitted it for you. You can check if a tax refund company has submitted a form for you by looking in the ‘Repayment Instructions’ section.

This section will be completed with the company’s details. This means the company will receive any refund on your behalf and take its fee before passing the remainder onto you.

If you do not remember asking a tax refund company to submit the form for you, then you should read our article Why is my tax refund being sent to a third party I’ve never heard of? here.

What is the point of the letter?

HMRC have identified a risk of some tax refund companies trying to exploit the PPI repayment process by submitting claims which are incorrect, inflated or not properly authorised by the taxpayer.

HMRC will now require evidence of a PPI payment before they progress a claim for a tax refund. Claims can continue to be made using the existing R40 form. but from 26 October 2023 onwards, supplementary evidence must be attached.

By asking for evidence of the PPI payment before they pay any money out, HMRC are

- making sure that they only pay out genuine claims and/or

- putting you on notice that a claim has been submitted by a tax refund company – which should be very helpful if you were unaware of this.

We expect that people making genuine claims will be able to easily provide the supplementary evidence that is being requested. Legitimate agents who have a good and proper relationship with their clients should be able to interact with them to get the evidence and should also therefore easily be able to provide it.

What should I do?

Check the details in the R40 form carefully. You should especially check the Repayment Instructions section of the form as this is where a tax refund company will put their details so that they can receive the refund on your behalf.

If all the details on the form look correct, you will have to decide if you want to pursue the claim. If you do, and you are happy for any agent/refund company listed in the Repayment Instructions section to get your refund in the first instance, then you should proceed with getting the evidence (see question below). Once you have it, you should return the R40 and the evidence to HMRC as per the instructions on their letter.

If the details on the form do not look correct and/or you do not wish to proceed, read our question ’I don’t want to proceed with the claim.’

Where do I get the evidence?

When you applied for PPI compensation, you should have received a letter, confirming the decision to pay you compensation, called the final response letter. It should contain a breakdown of the amount you received. It may have looked something like this:

| A | Full refund of PPI payments | 1,000 |

| B | Associated interest paid on them | 200 |

| C | 8% interest (on A + B for each year since you got the PPI) | 800 |

| D | Gross redress amount (A + B + C) | 2,000 |

| E | Income tax deducted (20% x C) | 160 |

| F | Net interest paid to you | 640 |

If you do not have the final response letter, or in the rare event a breakdown like the above was not shown, you can request a certificate from the financial institution that paid you back your PPI showing the tax deducted.

You may need to search the internet for the contact details of the financial institution to request the documents. You may be able to contact them by telephone, post, popping into a branch or by using an online tool (if they have one). If necessary, you can find a comprehensive list of financial institutions and their contact details on the FCA website. You will most likely need to provide your personal details, your PPI case number if you have it, and roughly when you received the PPI payout, so they can trace your case.

You may have used a claims management company to get your PPI in the past, but this should not stop the financial institution now providing you these documents directly.

What if my agent says they can help me get the evidence?

If you have made an informed choice to use the agent or refund company concerned and you want them to provide this additional service, because for instance you don’t have time, or you don’t know where to start, then that’s fine. You should carefully check whether you will have to pay any extra fees to the agent or refund company.

What if I don’t want to proceed with the claim?

HMRC have not processed the form that was submitted. They have sent it back to you. HMRC’s letter states that if you don’t reply, then they will not process the claim.

If you think you are due a tax refund on a PPI claim, you can make a claim yourself at some point in the future (although be aware of the deadlines!) - fairly simply and for free. We have some guidance on claiming a PPI refund, including an annotated form here. If you do this, you will receive the full refund directly, but please read the warning below carefully.

⚠️WARNING: Please be aware that if a refund company submitted a claim on your behalf that you now decide you do not want to pursue, they may try and recover a fee for work that they say has been done by them. This is a possibility if you signed a contract with them that provided for this, if they think that they provided you with their service in good faith and that the terms and conditions as to their service were clear and fair (and therefore enforceable). If they were to take legal action, a court would have to be persuaded of this. It is also the case that some refund companies have terms that say if you get the refund directly from HMRC yourself, they are still entitled to their fee as a percentage of the refund. If you are contacted with a request for fees, we recommend that you urgently take some advice from the Consumer Helpline as to whether they can legally pursue you for the money they say is owed as this is a legal issue, not a tax issue. HMRC cannot get involved in this issue.

What if my claim through a refund company was processed before this new rule came in?

We have more detail about using tax refund companies on our website which includes helpful guidance on what to do if you feel you have been caught out by an unscrupulous company:

- https://www.litrg.org.uk/tax-guides/tax-basics/how-do-i-claim-tax-back/should-i-use-tax-refund-company

- https://www.litrg.org.uk/news/why-my-tax-refund-being-sent-third-party-ive-never-heard

- https://www.litrg.org.uk/news/have-you-been-affected-tax-credits-ltd

You may also find it helpful to look at some of the online reviews of the tax refund company concerned (for example Trustpilot https://uk.trustpilot.com/).In some instances, taxpayers who feel they did not fully understand or authorise the claim will have detailed their experiences and actions that they have taken.

In addition, if you believe that a tax refund company has made a fraudulent tax claim, you may want to consider reporting this to HMRC via their online form.