Tax refund companies: Nominations and Assignments

Even though it is no longer possible to ‘assign’ your tax refund to a third party, do not let your guard down! As it is possible to still ‘nominate’ a third party to receive a tax refund, many of the same old issues with unscrupulous tax refund companies remain. Here we explain the differences between nominations and assignments, and what the change means for taxpayers and tax refund companies.

Content on this page:

Following a consultation in 2022, HMRC made plans to tighten up the tax refund company market, with the aim of protecting taxpayers. As part of these plans, assignments of income tax repayments (refunds) were rendered void with effect from 15 March 2023. These assignments were sometimes referred to as ‘deeds of assignment’.

What’s the issue?

Tax refund companies help taxpayers organise and submit claims for tax refunds from HMRC – for a fee – normally a percentage of the refund. Tax refund companies will usually ask you to sign something telling HMRC to send them your refund in the first instance, so that they can take their fee before paying what is left over to you. This is where nominations and assignments come in – more on these below.

Fees can be unclear and/or high and the charging structure can incentivise poor practice on the part of the tax refund company – with some unscrupulous companies turning to questionable tactics to generate new work or putting in inflated or fraudulent claims, for example. Because only assignments and not nominations have been banned – meaning there is still a way for refund companies to access repayments – many of these issues will continue unless further steps are taken by HMRC.

How is a nomination different from an assignment?

If you assigned a tax refund to a third party, such as a tax refund company, (possible until 15 March 2023), this meant that the third party became legally entitled to your tax refund.

Because an assignment was legally binding, HMRC were obliged to make the tax refund to the tax refund company or other assignee – provided the assignment was valid.

It was only possible to revoke (cancel) an assignment if both you and the third party (tax refund company) agreed to revocation.

It was important to check the wording of an assignment. Some assignments covered specific refunds, but others covered all available tax refunds for a specified tax year.

If you nominate someone else, such as a tax refund company, to receive your tax refund on your behalf, this is called a ‘bare’ nomination. You, the taxpayer, remain legally entitled to the tax refund.

This means you can withdraw the nomination if you choose – you do not need the agreement of the other party. You can withdraw the nomination simply by contacting HMRC, including over the telephone.

In addition, because you remain legally entitled to the refund, HMRC are not legally obliged to follow the nomination – they comply with it at their discretion.

Nominations normally only apply to the specific refund and not to any other refunds for a tax year.

What changed on 15 March 2023?

With effect from 15 March 2023, as announced in the Budget, assignments of income tax repayments are void (this means they are treated by HMRC as having no effect).

Over the past few years, a growing number of tax refund companies had been asking their customers to sign deeds or letters of assignment in respect of tax repayment claims. These assignments meant that HMRC paid the tax repayment to the agent, not the taxpayer. The agent passed on the repayment to the taxpayer, after having deducted their fee.

It became apparent that some companies were abusing assignments. For example in the case of Tax Credits Ltd, individuals thought they were applying for a specific working from home refund via the company, only to find that as a result of the online sign up processes used, they had unwittingly entered into an assignment for an entire tax year (or tax years). This meant other unconnected tax refunds were also paid directly to the company, allowing them to take a significant slice of these extra refunds as their fee.

LITRG raised this issue with HMRC. Following a consultation in 2022, to which LITRG responded, HMRC said that they would render void assignments of income tax repayments.

This means that any assignments HMRC receive on or after 15 March 2023, including those signed before 15 March 2023, are treated by HMRC as having no legal effect. This does not affect nominations. It is still possible to use nominations in respect of income tax repayments.

As a concession to agents, HMRC are treating assignments received on or after 15 March 2023 as non-legally binding nominations. This is so that agents and taxpayers do not need to complete additional paperwork.

This means that HMRC will make the repayment according to the assignment/nomination. However, if the taxpayer contacts them prior to making the repayment, the taxpayer will be able to withdraw the assignment/nomination, so that HMRC make the repayment to the taxpayer.

Can tax refund companies still submit tax repayment claims?

Yes, tax refund companies can continue to submit tax repayment claims on behalf of taxpayers.

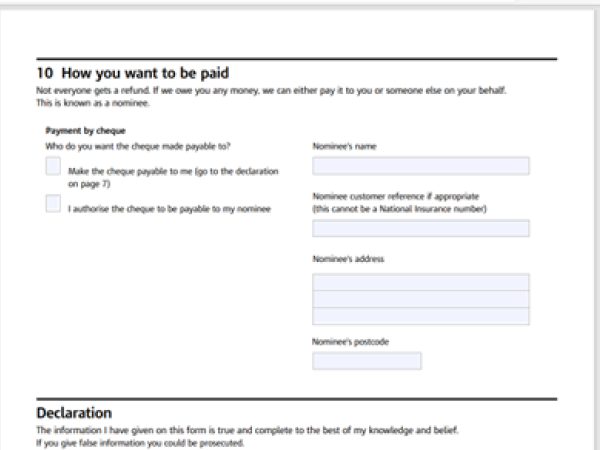

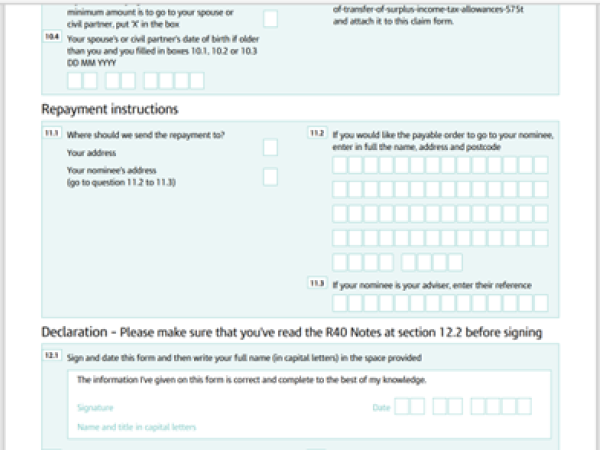

In addition, taxpayers can still ask HMRC to make the repayment to their agent or tax refund company via the nomination process. It is possible to make a nomination by completing the relevant boxes on many of the paper repayment claim forms that agents use, such as the P87, R40 and also on the Self Assessment tax return.

Examples of nomination sections:

P87

R40

It is also possible to make a nomination by letter or over the telephone.

Things to watch out for!

Although tax refund companies can no longer use assignments, as explained above, they can still use nominations, so there are still things to watch out for when claiming repayments of tax through a tax refund company.

If you are on the internet or on social media and see an ad or content about tax refunds, be careful what you click on and that you do not provide your details and signature electronically, unless you really want to sign up to use the company’s services. It is possible that the information that you provide may be used to populate a tax refund claim form (along with a completed nomination section).

HMRC should send you notification that a tax refund is about to be paid to a nominee shortly before it is paid. If you do not remember making the claim or authorising anyone to do it for you, then it is possible that you signed up for a service inadvertently or your details and signature have been shared with a connected tax refund company as part of a previous or different claim service. For example, some cases we have heard of appear to suggest that a PPI claim ‘a few years back’ with one company seems to result in a tax refund later being sent to the other company – the inference being that the signature given on the PPI claims management company paperwork has now been used to generate an R40 claim by a tax refund company for tax purposes.

If you become aware that a tax refund company has made a claim for a tax refund on your behalf without your knowledge or full understanding as to what was involved, and they have asked HMRC to make the repayment to them, remember that this is a nomination, not an assignment. This means it is not legally binding on HMRC and you are able to withdraw it by contacting HMRC – without asking for the agreement of the tax refund company.

If you are not in time to stop HMRC making the repayment to the nominee, but feel you did not give proper authority, you can find some guidance on what steps you can take here.

⚠️ Note – if you cancel a nomination so that you receive the full refund directly, it is possible that the tax refund company may try and recover their fee from you directly based on the contract you signed with them. This is a possibility if they think that they provided you with their service in good faith and that the terms and conditions as to their service were clear and fair (and therefore enforceable). If they were to take legal action, a court would have to be persuaded of this. If you are contacted with a request for fees, we recommend that you urgently take some advice from the Consumer Helpline as to whether they can legally pursue you for the money they say is owed as this is a legal issue, not a tax issue. HMRC cannot get involved in this issue.

Self Assessment

You can nominate someone to receive a refund that is generated through a Self Assessment tax return. Some tax refund companies will use Self Assessment tax returns to claim very large refunds on your behalf. Although HMRC do some initial checks when returns are submitted, in many cases they will process the claim and then check it later – at which point if they don’t agree you were entitled to the refund they may ask for the whole amount back (including the amount the refund company took as their fee).

If you decide to use a tax refund company to make a tax refund claim and they do this via submitting a Self Assessment tax return on your behalf, you should pause and think. Why are they doing this? It would be quite unusual for a tax refund claim for employment expenses to need to be made on a tax return for example, as we explain throughout our page of guidance here.

If their explanation sounds legitimate, you should ask to see the tax return that they are submitting before they submit it. This is so you can check the entries in the main body of the form and in the nomination section are in line with what you were expecting. Although you may not be an expert in tax, you should be able to spot if a company who has told you they will help you claim employment expenses has actually used your Self Assessment return to put in a claim for a specialist investment relief or if the nominee details look wrong.

Where can I find more information?

If you think you have paid too much tax, for example, through PAYE on your wages, or on a PPI pay out, there is guidance about how to claim tax back from HMRC yourself, on our website.

We also provide information to help you decide how best to submit your tax repayment claim – and whether you should use a tax refund company.

You can find HMRC’s consultation on protecting customers claiming tax repayments, as well as the outcome of the consultation, on GOV.UK.

The consultation arose in part following pressure from LITRG on HMRC to investigate the end-to-end process used by Tax Credits Ltd. Read our news article and Press Release on our website.

HMRC’s information about nominations and assignments can be found in the PAYE manual.