More ‘side hustle’ tax help

Despite ongoing efforts by tax professionals up and down the land, we are still seeing a large amount of confusion about the ‘new’ side hustle tax reporting rules for online platforms. There is no new tax on side hustles. Here, we reiterate the main things you need to know, provide a new flowchart to help explain the tax rules and deal with some important emerging questions.

Content on this page:

As set out in our original article and subsequent press release, there is no new ‘side hustle’ tax. The new rules relate to reporting requirements between various online platforms and HMRC. They do not create new tax obligations for individuals – the rules about who needs to declare their income, who needs to register for a self assessment tax return, when to register and how much tax people must pay in relation to their activity are already in place and have not changed.

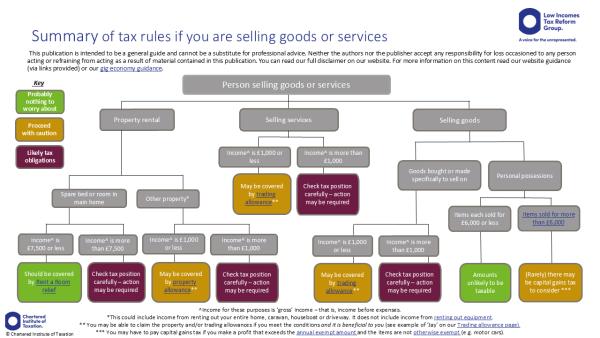

We know this is a complex topic and that some people do not like reading about tax. To help people who are selling goods or services online understand, at a glance, whether they have any tax issues to deal with, we have developed a flowchart. Our flowchart gives a summary of tax rules if you are selling goods or services online.

View our PDF flowchart

In addition, in the last week, we have been asked the following questions. Some of the replies might be useful to others, so we have posted the questions (and our answers) anonymously below.

Can a one-off transaction amount to trading?

Yes, a one-off transaction can be considered trading for income tax purposes. Whether or not a transaction is trading depends on various factors known as the ‘badges of trade’. These include the intention of the taxpayer, the frequency and volume of transactions, the holding period of the assets, and the nature of the assets being traded. If a one-off transaction is conducted with the intention of making a profit and it meets some of the other criteria for trading, it may fall within the scope of income tax.

For example, if someone seeks out a pair of rare trainers to sell on, as they know they will be able to get double the price on the open market, then even though they are just selling one item, this may be an ‘adventure in the nature of a trade’. Conversely, selling lots of items does not necessarily mean you are trading – someone selling their child’s old clothes and toys may have hundreds of transactions but is unlikely to be trading.

I will sell more than 30 items a year but I will not be trading, or I will be trading but I am able to use the trading allowance. Will HMRC know the difference from the data they get?

There are many unknowns with regards to how, or even if, HMRC will use all of the data that is sent to them. But, based on previous HMRC compliance exercises, we anticipate that they will risk assess the data before acting on it. This means that even if they receive information about you because you sell over 30 items, we would expect them to try and filter out people that clearly appear not to be trading, or who are trading but appear to earn less than £1,000 and are able to make use of the trading allowance, before doing anything with the data.

If HMRC do write to you asking you about the income, you can simply confirm, as a matter of fact, what you were or are doing. For example, that you were selling personal possessions only, or that you were trading but earned less than and are able to use the trading allowance and therefore had no reporting obligations. In reality, the UK has a self-assessment system, with the onus on you to report what needs to be reported. Provided you are keeping good records that clearly demonstrate the nature and value of the items that are being sold and that explains inclusions and exclusions in your workings/reported figures, this would usually be enough.

⚠️ Note – you should only use the trading allowances if you meet the conditions and it is beneficial to you – more information is available on our trading allowance page.

Can I open multiple accounts to stay below 30 items?

As we explain in our original article, if you carry out fewer than 30 transactions during the calendar year for less than 2000 euros through a particular platform then they will not need to report information about you to HMRC.

So, what happens if you set up multiple accounts within the same platform to try and each is below the 30 transaction limit? In general, if there is no legitimate reason for this, it may be viewed as artificial. Moreover, it is unlikely to make any difference because HMRC’s guidance says ‘Where a Seller has multiple accounts on a Platform, these should be aggregated to determine whether this category of exclusion applies.’ In other words, it means platforms are told to add up the number of items you are selling across the platform, from all of your accounts with that platform, when looking at whether you have sold more than 30 or more than 2000 euros.

What if I have accounts with more than one platform?

Our understanding is that the reporting rules apply to each platform separately. There is no aggregation across different platforms.

However as we set out in our original article, the reporting rules for platforms do not change the underlying tax rules for individuals. Even if a platform does not have to report your transactions to HMRC, you will still need to report them and pay tax if required under the current tax rules. Not doing so when you know you should, particularly if you take active steps or make arrangements to try and hide information from HMRC, may well be considered tax evasion, which is very serious.

I think I should have paid some tax; how do I work out how much it is?

There are basically two steps:

- Quantify net profit in each of the tax years - People who are trading need to firstly work out their net profit in each of the tax years since the activity started. This is basically income less expenses. We introduce the idea of net profit and look at some common expenses in our gig economy guidance. If you need more detailed information on how to do this, you can find this here.

- Work out if any tax or National Insurance is due on the net profit - We provide a basic example of how you work out your tax and NIC in our gig economy section. Note that if you have any spare personal allowances available in any of the tax years to cover some or all of the net profit, the tax due may be nil or low, however you may still need to consider National Insurance (which, historically, has been payable from a lower net profit level). You can find current and past tax rates and allowances on our website.

What should I do if I owe money and need to make a disclosure?

In the first instance, we recommend speaking to HMRC to explain your circumstances (the relevant phone number is 0300 123 1078) and asking them what action they would like you to take.

For tax years 2022/2023 and 2023/24, they should usually be content for you to register for self assessment and just send in a tax return, rather than make a disclosure. Also, occasionally, where there is an isolated error and the tax at stake is minimal, HMRC may agree that no further action is required.

If HMRC want you to make a disclosure

HMRC have an online Digital Disclosure Service that you can use. You need a Government Gateway user ID and password to use the Digital Disclosure Service. If you do not already have a user ID, you need to create one as part of the process.

Official guidance on how to make a disclosure using this service is on GOV.UK.

First, you need to notify your intention to disclose via this service. HMRC will give you a unique disclosure reference number.

Once you have notified an intention to make a disclosure, you will have 90 days to:

- gather together the information you need to complete your disclosure;

- calculate the final liabilities including tax, interest, and any penalties. Note 1) there are calculators within the facility to help you with the interest and 2) you self-assess your penalties – for more on this see below);

- complete the disclosure and pay what you owe, using the unique disclosure reference number provided when notifying. If you owe tax, but cannot afford to pay it all in one payment, contact HMRC. You can ask HMRC about setting up a Time to Pay arrangement. If HMRC agree to offer you Time to Pay, this will spread the payments of tax that you owe over several months.

The process of calculating your liabilities and completing your disclosure can sometimes be complex, so even if it means having to pay, there may be no substitute to finding a professional adviser to assist you.

If you choose to go down this route, they will be able to help you rectify all of the past irregularities and then support you with your taxes on an ongoing basis.

Your adviser will be able to tell you how many tax years are assessable and need to be disclosed, in your circumstances.

You should be aware that there can sometimes be penalties in relation to non-declaration of income. These penalties are tax geared, so it will be important to ensure all possible reliefs have been considered in arriving at the tax due figure, including all trading expenses.

You should also ensure you have considered whether or not you have a reasonable excuse for the non-disclosure of the income, as well as whether there are any other circumstances to mitigate the penalties which might otherwise be due. Having a reasonable excuse may also restrict the number of tax years which would otherwise be assessable.

How do I manage my taxes going forward?

Please see the guidance in our gig economy section for lots of information on what you need to do for your tax if you have just started trading, what to do if you work in the gig economy but are also working elsewhere and how to complete your tax return, including where you work through multiple platforms.

We also encourage you to read our booklet on tax if you are self-employed as even though it is not specific to the gig economy, you will also pick up useful information to stand you in good stead for dealing with your tax affairs in the future.

Final thoughts

This is a tax topic that clearly has worried many people. If you feel it would be beneficial for LITRG to expand on any of the areas covered here or publish answers to other questions or if you do not think we have covered what you wanted to know, please do contact us.