How do I complete the Starter Checklist if…?

Recently, we have been contacted by people who are struggling to complete the Starter Checklist when they start work with a new employer. Here we look at some of the most common scenarios

Content on this page:

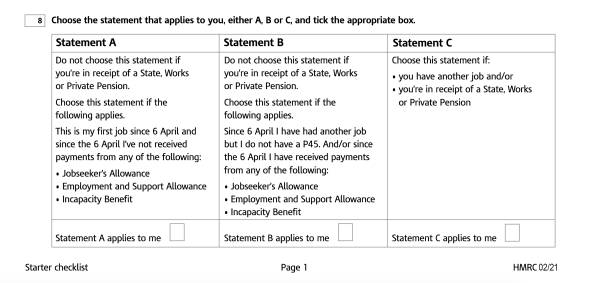

On a Starter Checklist, an employee is asked which statement applies to them. Depending on what statement you pick, your employer will allocate you a tax code and work out the tax due on your first payday. You can read more about Starter Checklists, in general, in our main website guidance.

It is important to complete the Starter Checklist correctly – we explain more about completing the Starter Checklist, and the amount of tax you will pay as a consequence, in a previous article.

However, sometimes it can be difficult to know what statement to pick if your situation does not fall neatly within the different scenarios outlined in Statements A – C…

⚠️ We recommend always keeping a copy of the completed Starter Checklist for your records.

It is proof of how you completed it and can help in any disputes there may be with HMRC as to who is liable (you or your employer) if the wrong tax code is used.

I was self-employed until before I took my new job…

If you have a technical interest in the law, regulation 46 of the PAYE regulations is the relevant reference here.

The ‘job’ mentioned in Statements A to C relates to employment only, so any self-employment can be ignored for this purpose. But this means that your full personal allowance will be set against the earnings from your new employment through the payroll. That means there may be no allowances to set against your self-employment income so do put some funds away to pay the tax bill associated with your self-employment.

I was living and employed abroad before I moved to the UK…

If you have moved to the UK from abroad and have become UK tax resident (you can read about that here), it is possible that your pre arrival income will be excluded from UK tax because of ‘split year’ treatment or because of double tax relief. You can read about these in our main website guidance.

Statement A of the Starter Checklist is likely to be the most appropriate. This will give you full unused personal allowances from the beginning of the tax year to set against your UK income for the remainder of the tax year.

If you have foreign income arising while you are in the UK (as opposed to before you arrived), you may, in certain circumstances, need to complete a UK tax return to report it to HMRC as explained in our main website guidance.

I was paid a small amount of money ‘cash in hand’ earlier in this tax year…

Firstly, if the activity was performed by you on a self-employed or casual basis, then you may be able to benefit from the Trading Allowance.

The ‘job’ referred to on the Starter Checklist is referring to employment rather than self-employment. Accordingly, if the activity was not on an ‘employed’ basis and you have received no taxable benefits since 6 April 2021, then Statement A would seem appropriate. This will give you the benefit of all the unused personal allowances since the beginning of the tax year.

If the activity was on an ‘employed’ basis, then strictly Statement B would be appropriate. This is likely to mean that you will overpay tax during the year as we explain here.

I haven’t got my National Insurance number (NINO)…

Provided you can prove that you have the right to work in the UK, you can start work without having a NINO. There is no time limit.

If you don’t have one – you can find information on how to apply for a NINO online on GOV.UK.

If you have had one in the past, but have lost or forgotten it, this information on our website tells you how to confirm your NINO. If you want to use your Personal Tax Account (PTA) to confirm your NINO, we tell you how to access your PTA (without needing to enter your NINO as part of the process) here.

In either case, you should tell your employer that you are trying to apply for/confirm a NINO and once you have it, give the NINO to them.

You can also complete the Starter Checklist so that you are able to be set up on the payroll. You should leave the NINO field blank.

I received a Self-Employment Income Support Scheme (SEISS) grant but am now starting a job under PAYE…

SEISS is a taxable grant from the government but for Starter Checklist purposes, it is not counted as a taxable benefit like Jobseeker’s Allowance, nor is it counted as a ‘job’.

On this basis, Statement A would seem appropriate (assuming you haven’t had another job or taxable benefits in the tax year). Do be aware that this means that your full personal allowance will be set against the earnings from your new employment through the payroll. That means there may be no allowances to set against your SEISS grant and other self-employment income.

I received Carer’s Allowance but am now starting a job under PAYE…

The only taxable benefits that are listed as relevant are Jobseeker’s Allowance, Employment and Support Allowance (ESA), Incapacity Benefit or state pension.

Carer’s Allowance (and Carer’s Allowance Supplement in Scotland) is also a taxable benefit – it is not specifically mentioned alongside the other taxable benefits listed in the Starter Checklist. This can lead carers to tick box A rather than box B, even though Statement B is the most appropriate option. It is important to understand that while ticking box A can lead to you being given the benefit of the full tax free personal allowance to set against your employment earnings, this may mean that you have an underpayment in respect of the Carer’s Allowance at the end of the tax year.

For completeness, the Starter Checklist also does not make clear that:

- all types of Jobseeker’s Allowance count (new style, contribution-based and income-based)

- only new style and contribution based Employment and Support Allowance counts

We have raised all these issues with HMRC.